steven grammont

NES Member

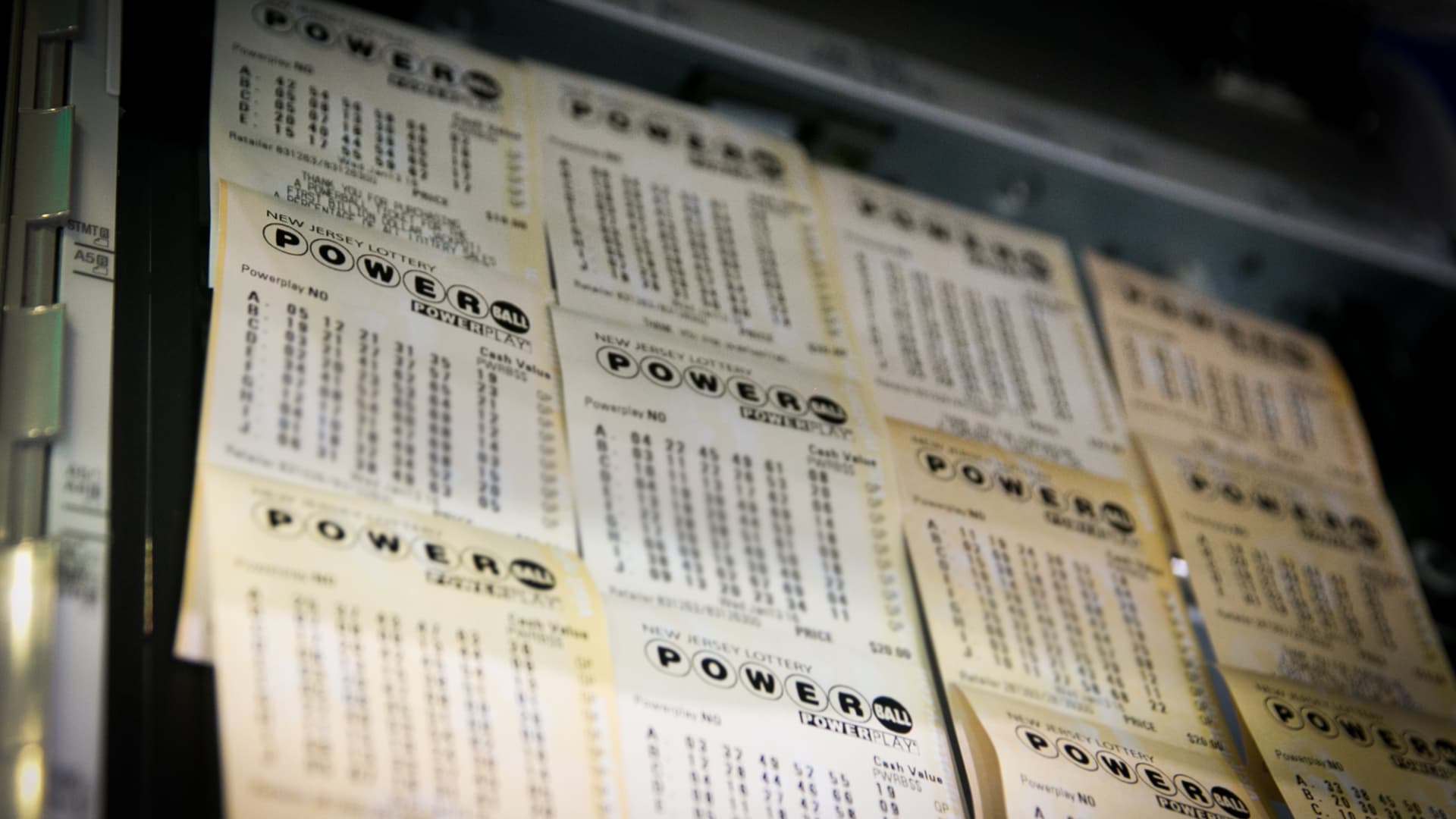

We should definitely do this again in the members only forum. Set out some real rules.. may be a minimum of five tickets per person

I've always thought buying more than one ticket is a complete waste ........ Just my opinion