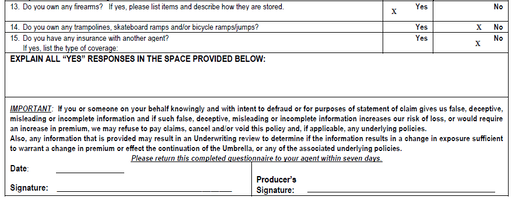

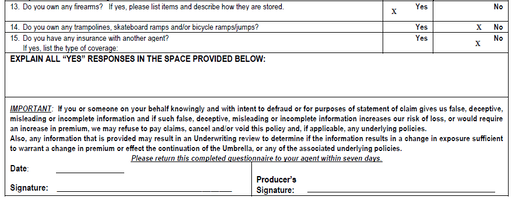

I just got a questionnaire for renewing my umbrella policy. They're asking if I own firearms, and if yes, for a list of items and how they're stored. Is this common practice? I've never seen this before, and don't particularly want to fill it in.

And the box is WAY too small, lol

Anyone else been through this?

And the box is WAY too small, lol

Anyone else been through this?