Varmint

NES Member

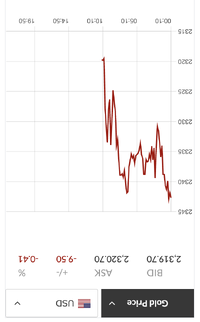

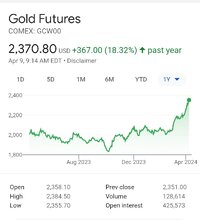

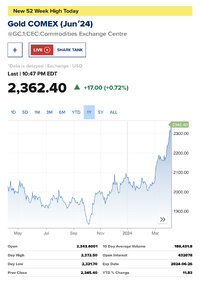

Gold is setting record highs, but why prices are soaring now is a complete mystery

“The rally is defying a lot of normal thinking, especially when it comes to still-elevated rates.”fortune.com

Good summary of the possible reasons for gold’s rise, although I think primarily it’s due to technical trading. Gold broke out of its decade long cup and handle and is following that pattern to $2350 and $2500.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)