From the WSJ:

Metal Prices Mixed as Gold Slips But Copper Gains on Positive Data

1016 GMT – Metal prices are mixed, with copper pulling ahead but gold futures slipping 0.1% to $2,312.6 a troy ounce. The precious metal has, however, rallied 3.3% over the last week and 12% in the year to date, following the Federal Reserve’s reiteration of rate cuts being more than likely this year, SP Angel analysts say in a note. Traders are now pricing in two interest-rate cuts this year, SP Angel says. Elsewhere, copper rises 0.8% to $9,370.5 a metric ton, and 5.6% in the last week alone as manufacturing data improves and supply constraints persist, SP Angel says. The move caught the market by surprise, likely reflecting some short covering and momentum fund inflow—but longer-term demand prospects are improving, with U.S. manufacturing showing a rebound from a sustained downtrend, SP Angel says. (

[email protected])

Gold Prices Likely Have Room to Run

0812 GMT – Gold prices may have further room to run in the medium term, OCBC foreign-exchange strategist Christopher Wong says in a note. The precious metal’s recent price rally has brought gains this year to more than 11%. While the analyst thinks a near-term pullback is possible, given the rapid run-up, he maintains a bullish outlook on gold prices. Wong cites factors such as expectations of a global easing cycle, central banks’ continued purchases of gold and a play-up of the precious metal’s role as a geopolitical hedge. Spot gold is 0.3% lower at $2,293.38/oz after hitting a new record. (

[email protected])

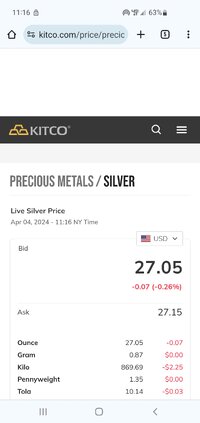

Base Metals Rise on Speculative Trading, European Monetary Policy Hopes

0754 GMT – Base metals rise, benefiting from the continued risk-on appetite that gripped markets earlier this week. Aluminum rises 0.5% to $2,451.5 a ton, while copper gains 0.55% to $9,346.5 a ton. Speculative activity on the LME has surged, which—combined with expectations of relaxed monetary policy outlook in Europe—has sent metal prices to their highest levels in several months, Daria Efanova, head of research at Sucden Financial, says. Gold futures rise 1% to $2,316.9 a troy ounce while LBMA silver rises 2.3% to $26.25 an ounce. “We expect the forthcoming months to be favorable for precious metals, given the potential onset of monetary easing by major central banks and the increasing uncertainty surrounding the outcome of the U.S. elections,” Efanova says in a note. (

[email protected])

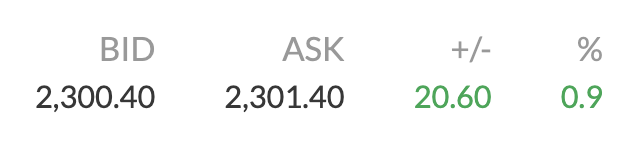

COMEX Gold Futures’ Bullish Momentum Remains in Play, Chart Shows

0655 GMT — COMEX gold futures’ bullish momentum remains in play on the daily chart, given price action overnight together with the relative strength index indicator trending upwards, says Joseph Chai, head of Retail Research at RHB, in a commentary. The 20-day and 50-day simple moving averages are still moving upward, suggesting the underlying trend remains bullish, and futures could extend the trend toward $2,400/oz followed by $2,500/oz, Chai says. Despite Wednesday’s break beyond the $2,300/oz resistance level, however, RHB doesn’t rule out possibility of the precious metal undergoing profit-taking, says Chai who pegs support at $2,250/oz. Spot gold is 0.1% lower at $2,295.50/oz. (

[email protected])

![Thumbs Up [thumbsup] [thumbsup]](/xen/styles/default/xenforo/smilies.vb/044.gif) . Fortunately I never try to time anything. I just buy what I can afford when I can afford it.

. Fortunately I never try to time anything. I just buy what I can afford when I can afford it.