-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

-

Be sure to enter the NES/MFS May Giveaway ***Canik METE SFX***

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

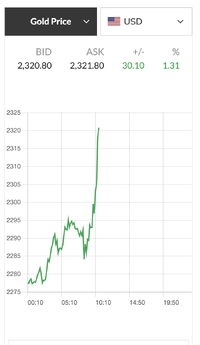

Gold and silver prices are down

- Thread starter Rider

- Start date

Varmint

NES Member

Gold and miners could use a breather, but it’ll probably be short and shallow.

- Joined

- Jan 20, 2022

- Messages

- 3,234

- Likes

- 15,897

Copper will double in price over the next 7 years.

The Green Future Requires lots of Red Metal

The Green Future Requires lots of Red Metal

Picked up GDXU at the dip again today below $35. Glad I did!

Duxprep

NES Member

What's interesting about this breakout is that it's not driven by FOMO retail sales. Dealers are reporting there are more sellers than buyers. This is Central Banks, Governments and perhaps institutional activity. They know something we don't and appear to be preparing. If thats the case then this price at 2345 should still be considered low and we should be buying

Congratulations on your run with the 3X gold funds, definitely not for the faint of heart….Picked up GDXU at the dip again today below $35. Glad I did!

So on Weds the FRB denied a FOIA request for NYFB gold custodial holdings before and after the freeze on Russian gold and treasuries.  This was after Rep. Alex Mooney of WVa asked Powell about US gold holdings back in a December letter

This was after Rep. Alex Mooney of WVa asked Powell about US gold holdings back in a December letter

“Board staff consulted with staff at the Federal Reserve Bank of New York (‘Reserve Bank’) and have been advised that such records, if they exist, would be Reserve Bank records, and consequently, not subject to the Board’s Rules Regarding Availability of Information,” the Fed said.

The Federal Reserve said that this publication could take its request to the New York Fed. However, that institution isn’t subject to FOIA.

According to Stefan Gleason, CEO of Money Metals Exchange, a large online precious metals dealer and depository based in Idaho, "The Fed doesn't want anyone to know that foreign governments and other central banks are yanking their gold from America's shores because it would reveal the folly of U.S. monetary and foreign policy."

“They’re just passing the buck to the New York Fed. The FRB could obtain the data from the New York Fed if it wanted to, and then could share it with you if it wanted to. The Fed chairman has already essentially told Representative Mooney that the Fed doesn’t want to disclose the information,” said Chris Powell, secretary-treasurer of the Gold Anti-Trust Action Committee.

“Board staff consulted with staff at the Federal Reserve Bank of New York (‘Reserve Bank’) and have been advised that such records, if they exist, would be Reserve Bank records, and consequently, not subject to the Board’s Rules Regarding Availability of Information,” the Fed said.

The Federal Reserve said that this publication could take its request to the New York Fed. However, that institution isn’t subject to FOIA.

According to Stefan Gleason, CEO of Money Metals Exchange, a large online precious metals dealer and depository based in Idaho, "The Fed doesn't want anyone to know that foreign governments and other central banks are yanking their gold from America's shores because it would reveal the folly of U.S. monetary and foreign policy."

“They’re just passing the buck to the New York Fed. The FRB could obtain the data from the New York Fed if it wanted to, and then could share it with you if it wanted to. The Fed chairman has already essentially told Representative Mooney that the Fed doesn’t want to disclose the information,” said Chris Powell, secretary-treasurer of the Gold Anti-Trust Action Committee.

My stop loss triggered this morning when there was a dip... Lol. Then price shot up. Story of my life.

richc

NES Member

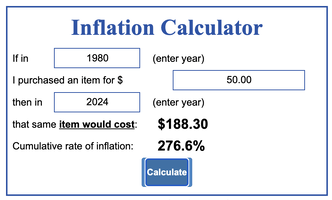

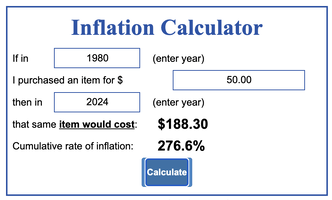

Back in 1980 silver hit $50/ounce. So I got to wondering what that would equate to in today's inflated dollars?

For the record in 1980 the Hunt Brothers tried to corner the silver market. There were certainly unusual forces at work. But even half of that would be awesome!

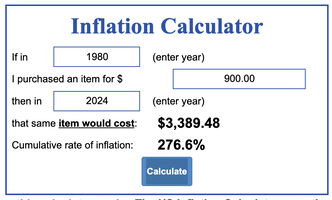

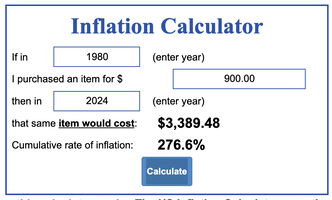

So what about gold?

At the same time silver as hitting all time highs, gold went along for the ride hitting $900 an ounce. So what would that be in today's dollars?

For the record in 1980 the Hunt Brothers tried to corner the silver market. There were certainly unusual forces at work. But even half of that would be awesome!

So what about gold?

At the same time silver as hitting all time highs, gold went along for the ride hitting $900 an ounce. So what would that be in today's dollars?

richc

NES Member

Now I can see some of you arguing that I took the high end of pricing for those metals in 1980. Fair argument, actually. So I went looking for lows to make a comparison.

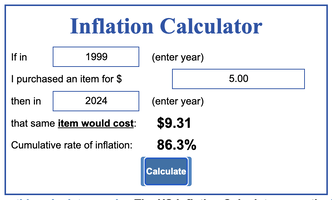

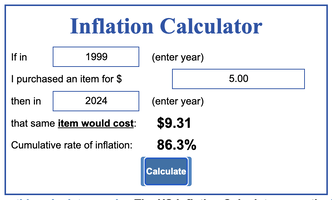

In 1999 silver traded as low as about $5.00/ounce. In today's dollars that would be...

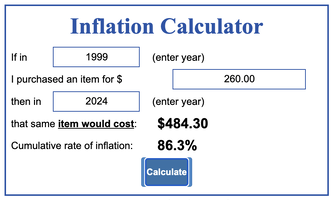

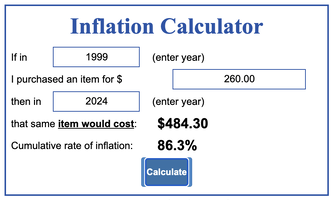

So in 1999 gold hit a low of about $260/ounce. So what would that cost today in inflation adjusted dollars?

All I can say about the giant disparity in these numbers is... I have no idea what it means. And it appears the starting point for one's analysis has a huge impact on the results you see...

In 1999 silver traded as low as about $5.00/ounce. In today's dollars that would be...

So in 1999 gold hit a low of about $260/ounce. So what would that cost today in inflation adjusted dollars?

All I can say about the giant disparity in these numbers is... I have no idea what it means. And it appears the starting point for one's analysis has a huge impact on the results you see...

In the early '70's' the billionaire Hunt Brothers by correctly, forecasting looming inflation caused by the Vietnam War and 'The Great Society' spending. They began leveraging massive silver contracts, eventually, 'owning' about 1/3 of the World's silver. But like all mortals the Hunt brothers silver was actually revealed to be pot metal, by 1980 they were bankrupt. Silver Thursday - Wikipedia

With the BRIC Nations accumulating golden and silver reserves, "past performance doesn't guarantee future results".

With the BRIC Nations accumulating golden and silver reserves, "past performance doesn't guarantee future results".

richc

NES Member

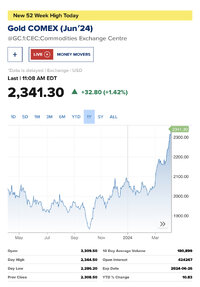

Why record-setting gold prices will fend off headwinds and see 30% more upside, according to famed economist David Rosenberg

Gold's recent rally has puzzled as macro headwinds typically weigh on gold prices. But David Rosenberg sees a 30% more upside ahead.

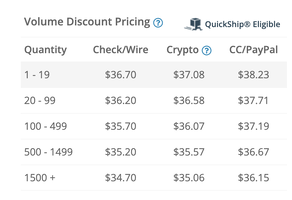

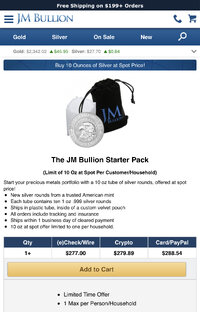

Buy Gold & Silver Bullion Online | Free Shipping - JM Bullion

Buy Gold, Silver, and Platinum bullion online at JM Bullion. FREE Shipping on $199+ Orders. Immediate Delivery - Call Us 800-276-6508 - BBB Accredited.

chris_1001

NES Member

I get that from Safari on my phone. Worked for me using the desktop web interface, though. Added then selected payment method. Had me ready to check out. I didn't complete the purchase because I'm not in the market for more physical silver at present.Guess they are out. Tried to add it to my cart, but tells me after there is nothing in my cart.

- Joined

- Jan 20, 2022

- Messages

- 3,234

- Likes

- 15,897

If you like losing while the sp500 goes up and gold goes up. Buy silver. All I ever do is lose on silver. I tell everyone I know. Anything but silver.

Pretty sure silver has lost to inflation. I'd make more profit putting my cash in a money market the last few years

Pretty sure silver has lost to inflation. I'd make more profit putting my cash in a money market the last few years

Grendizer138

NES Member

My guy, if you’re that down on them I’ll buy all the silver eagles you have at $30/ea. Boston Bullion currently has them at $31.43.If you like losing while the sp500 goes up and gold goes up. Buy silver. All I ever do is lose on silver. I tell everyone I know. Anything but silver.

Pretty sure silver has lost to inflation. I'd make more profit putting my cash in a money market the last few years

Otherwise, learn patience and stop bitching.

richc

NES Member

Gold is setting record highs, but why prices are soaring now is a complete mystery

“The rally is defying a lot of normal thinking, especially when it comes to still-elevated rates.”

- Joined

- Jan 20, 2022

- Messages

- 3,234

- Likes

- 15,897

I hate silver so much. I won't sell it to my clients. I talk them into goldMy guy, if you’re that down on them I’ll buy all the silver eagles you have at $30/ea. Boston Bullion currently has them at $31.43.

Otherwise, learn patience and stop bitching.

chris_1001

NES Member

I’m in (paper) SLV at an average cost of $19.05 per share.I hate silver so much. I won't sell it to my clients. I talk them into gold

It’s been (an up and down ride)

ETA the missing,,,

Last edited:

You got me on pins and needles. How’s it been?It’s been

Varmint

NES Member

Back in 1980 silver hit $50/ounce. So I got to wondering what that would equate to in today's inflated dollars?

View attachment 869981

For the record in 1980 the Hunt Brothers tried to corner the silver market. There were certainly unusual forces at work. But even half of that would be awesome!

So what about gold?

At the same time silver as hitting all time highs, gold went along for the ride hitting $900 an ounce. So what would that be in today's dollars?

View attachment 869982

Well I’ll be disappointed if this bull market only gets us to $3400 and $188.

If you like losing while the sp500 goes up and gold goes up. Buy silver. All I ever do is lose on silver. I tell everyone I know. Anything but silver.

Pretty sure silver has lost to inflation. I'd make more profit putting my cash in a money market the last few years

I've been dollar cost averaging collectible coins and bars for awhile and yes, gold has been a better return, but diversification is good, and I think an argument could be made silver would be easier to sell because of the lesser cash needed by buyer.

Grendizer138

NES Member

I hope he’s ok, he lives a pretty wild life.You got me on pins and needles. How’s it been?

chris_1001

NES Member

f***ing autocorrect!!!You got me on pins and needles. How’s it been?

Share:

Similar threads

- Replies

- 6

- Views

- 176

- Replies

- 7

- Views

- 138