I'm sure this information is all given somewhere in the 329 preceding pages of this thread, but what resources are you guys using to keep up to speed with miners?Gold and silver junior miners still think gold is $1600 and silver is $20. Will be interesting when they finally adjust for reality.

-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

-

Be sure to enter the NES/MFS May Giveaway ***Canik METE SFX***

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold and silver prices are down

- Thread starter Rider

- Start date

Varmint

NES Member

I'm sure this information is all given somewhere in the 329 preceding pages of this thread, but what resources are you guys using to keep up to speed with miners?

We listened to a lot of podcasts and I have a couple of paid newsletters.

Which 3 do you find most useful?

I guess tomorrow is going to be interesting. They're selling the March CPI report as "make or break" for rate cuts later in the year. I can only surmise that they think that inflation is the only bad thing that is likely to happen, and rate cuts are a good thing. I'm thinking the market will overreact no matter what the outcome.

I guess tomorrow is going to be interesting. They're selling the March CPI report as "make or break" for rate cuts later in the year. I can only surmise that they think that inflation is the only bad thing that is likely to happen, and rate cuts are a good thing. I'm thinking the market will overreact no matter what the outcome.

richc

NES Member

My humble opinion. Volatility is now your friend.Which 3 do you find most useful?

I guess tomorrow is going to be interesting. They're selling the March CPI report as "make or break" for rate cuts later in the year. I can only surmise that they think that inflation is the only bad thing that is likely to happen, and rate cuts are a good thing. I'm thinking the market will overreact no matter what the outcome.

- Joined

- Jan 20, 2022

- Messages

- 3,229

- Likes

- 15,885

richc

NES Member

Varmint

NES Member

Which 3 do you find most useful?

I guess tomorrow is going to be interesting. They're selling the March CPI report as "make or break" for rate cuts later in the year. I can only surmise that they think that inflation is the only bad thing that is likely to happen, and rate cuts are a good thing. I'm thinking the market will overreact no matter what the outcome.

DJBrad can correct me, but for mining stocks I'd say:

Palisades Radio

Mining Stock Education

Korelin Economics Report

Those three are more balanced, many podcasts that cover gold/silver are too permabullish:

Soar Financially (they have some great guests but a lot of permabulls, who I like listening to, but you have to take their comments with a pound of salt)

Daily Gold Podcast (same as above)

Sprott Money (way too uberbullish, although they are finally turning out to be right lol)

Mining Stock Daily (lot of company interviews - be careful of any podcast interviewing a specific company, they always paint a rosy picture. I don't even listen to them)

For more economic/macro/prepping podcasts which sometimes cover gold/silver I like:

Thoughtful Money

Macro Trading Floor

Macro Voices

Financial Survival

Varmint

NES Member

Not me, at Costco I mostly buy vanilla ice cream and NY Strip or ribeye.

All goodDJBrad can correct me, but for mining stocks I'd say:

Palisades Radio

Mining Stock Education

Korelin Economics Report

Those three are more balanced, many podcasts that cover gold/silver are too permabullish:

Soar Financially (they have some great guests but a lot of permabulls, who I like listening to, but you have to take their comments with a pound of salt)

Daily Gold Podcast (same as above)

Sprott Money (way too uberbullish, although they are finally turning out to be right lol)

Mining Stock Daily (lot of company interviews - be careful of any podcast interviewing a specific company, they always paint a rosy picture. I don't even listen to them)

For more economic/macro/prepping podcasts which sometimes cover gold/silver I like:

Thoughtful Money

Macro Trading Floor

Macro Voices

Financial Survival

I also look for specific guests who also float from show to show every few quarters. Some are great for macro. Some are great for technicals.

richc

NES Member

Not me, at Costco I mostly buy vanilla ice cream and NY Strip or ribeye.

Excellent taste!!!

Varmint

NES Member

Bought some Falco Resources and Banyan Gold, two beaten down junior miners who haven’t really moved yet.

Sold Lion One Metals (they screwed the pooch on their financials) and Montauge Gold (ran up really fast) to pay for it. But still own some of both.

Sold Lion One Metals (they screwed the pooch on their financials) and Montauge Gold (ran up really fast) to pay for it. But still own some of both.

I’m curious about Q1 financials for gold producers and what fruits will come with such a higher gold price and dividends. Maybe cap ex on new acquisitions is a better allocation of cash flow.

Win

NES Member

They're not juniors but Hecla Mining and First Majestic are getting investors attention.

Varmint

NES Member

They're not juniors but Hecla Mining and First Majestic are getting investors attention.

I realized I own Hecla when I got the shareholder vote email this week. It’s in a forgotten Roth IRA.

I missed the dip today which would have netted me more shares. Oh well, you can’t win every trade.

Is this like stagflation on adrenochrome?

Is this like stagflation on adrenochrome?

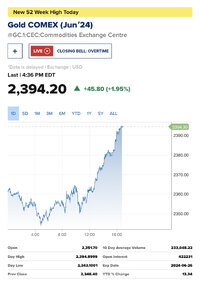

Tamer response than I expected. Looks like we back off of couple of days of gains and then probably get back to business in gold and silver. Anyway, I'm thinking most of the interest in gold is less about interest rate expectations than what might happen in the banking system or possibly geopolitically. Higher for longer just makes fears of a banking system crisis worse.

I don't know, but I do know that prices don't just reflect the health of the economy, and teasing apart what is due to what is not easy.

Is this like stagflation on adrenochrome?

I don't know, but I do know that prices don't just reflect the health of the economy, and teasing apart what is due to what is not easy.

I took a look at the CPI report. There are a lot of plusses and minuses. There are a lot of numbers period, but what 10 minutes suggested to me is that durables, commodities, and non-durables are not holding the numbers up, rather services, housing, and transportation.

Shanghai exchange sets trading limits on gold, copper futures as prices rally - The Economic Times

The Shanghai Futures Exchange (SHFE) will impose trading limits on its gold and copper contracts, it said on Wednesday, following sharp price rallies by both metals.

View: https://x.com/Sino_Market/status/1777984397930877383

Varmint

NES Member

I took a look at the CPI report. There are a lot of plusses and minuses. There are a lot of numbers period, but what 10 minutes suggested to me is that durables, commodities, and non-durables are not holding the numbers up, rather services, housing, and transportation.

This probably means the Buy the Dippers will disregard it after a few days and get back to business. They will find any way to justify their bullishness, and a mixed CPI report makes it easy.

The Fed however knows inflation isn't licked, so they're just going to wait to see what happens, ready to cut but only if something serious happens like the Treasury market seizing up or commercial real estate imploding. Until then they'll keep rates up.

I’m pretty disappointed in how miners are responding to the gold price. When miners were mooning in 2020 silver was barely hittin $28 in August. We are not only testing that silver high but gold has broken out way above the ATH. US equities were also pumping in 2020. It doesn’t make sense. Maybe the lack of M2, tighter credit markets, and lack of QE/stimulus is to blame.

Varmint

NES Member

Varmint

NES Member

I’m pretty disappointed in how miners are responding to the gold price. When miners were mooning in 2020 silver was barely hittin $28 in August. We are not only testing that silver high but gold has broken out way above the ATH. US equities were also pumping in 2020. It doesn’t make sense. Maybe the lack of M2, tighter credit markets, and lack of QE/stimulus is to blame.

Just gotta be patient - GDXJ is up 40% in 6 weeks, that's a huge gain. Juniors are lagging as usual, but they're also finally moving, and some are up 100%.

Some juniors are up 0%, and that's because they have to finance, and the deals are still shitty. Look at i80 Gold, one of the best developers, and they had to issue half warrants this week to get financing. This should change soon with gold at $2300.

Agree on the patience thing. Still the miners are not even close to their all time highs. They have so much ground to recover. Not even at 50% of the highs and we have Gold/Silver at breakouts or about to breakout. The finance thing is a sad affair and the fact that developers with teir 1 assets are granting warrants is abhorrent.Just gotta be patient - GDXJ is up 40% in 6 weeks, that's a huge gain. Juniors are lagging as usual, but they're also finally moving, and some are up 100%.

Some juniors are up 0%, and that's because they have to finance, and the deals are still shitty. Look at i80 Gold, one of the best developers, and they had to issue half warrants this week to get financing. This should change soon with gold at $2300.

Central banks are buying. Institutional is taking notice. Retail is busy masturbating to everything else.

Here’s an illustration of buy the dippers number go up

View: https://www.instagram.com/reel/C5aA0DQOYOG/?igsh=MWxiZDNlMjZxdm9yYw==

View: https://www.instagram.com/reel/C5aA0DQOYOG/?igsh=MWxiZDNlMjZxdm9yYw==

They're not going to be comfortable with it until they see unemployment ticking up, payrolls falling, stuff like that. CPI is interesting, I guess, but it is also a convoluted mess of disparate supply shocks, most of which have exactly nothing to do with monetary policy. Nothing says lower inflation like a workforce that can't afford to buy anything.The Fed however knows inflation isn't licked, so they're just going to wait to see what happens, ready to cut but only if something serious happens like the Treasury market seizing up or commercial real estate imploding. Until then they'll keep rates up.

Varmint

NES Member

They're not going to be comfortable with it until they see unemployment ticking up, payrolls falling, stuff like that. CPI is interesting, I guess, but it is also a convoluted mess of disparate supply shocks, most of which have exactly nothing to do with monetary policy. Nothing says lower inflation like a workforce that can't afford to buy anything.

Right, but if the Treasury market seizes up, all that stuff goes out the window and they’ll do rate cuts, QE or yield curve control as needed.

Varmint

NES Member

Agree on the patience thing. Still the miners are not even close to their all time highs. They have so much ground to recover. Not even at 50% of the highs and we have Gold/Silver at breakouts or about to breakout. The finance thing is a sad affair and the fact that developers with teir 1 assets are granting warrants is abhorrent.

Central banks are buying. Institutional is taking notice. Retail is busy masturbating to everything else.

My miner portfolio is no longer 90% red, so things are moving up. I’m actually green on Defiance Silver, that was a shock to see.

Share:

Similar threads

- Replies

- 6

- Views

- 152

- Replies

- 7

- Views

- 112