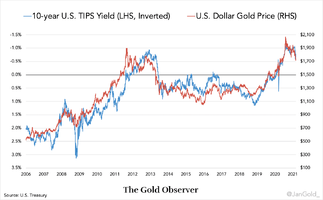

That Eskay grab was a good one for sure. That will become a great company if they don’t get snatched up via M&A.I think maybe silver stocks double bottomed today, hitting the Jan 27 lows, but just my gut feel.

gold stocks are bottoming for sure. Eskay is up 20% already.

Last edited: