HARRYM

NES Member

As an investor Silver seems sluggish at just under 29. I am not a Silver investor but a hedge holder is all. I will never sell it and tell the wife if the world goes to hell after I am gone, and the dollar is worthless, use it then to cover yourself.Sounds like Michael Burry on his bearish trades

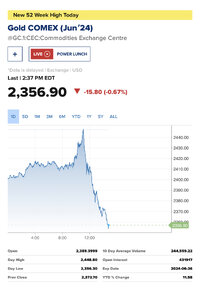

BTW I think it might be time to take profits.