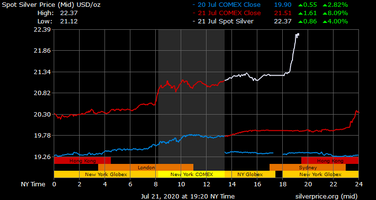

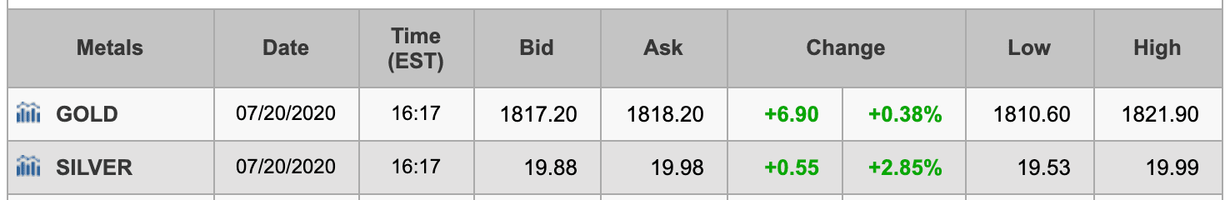

At the moment, and this is subject to change, anyone who has bought PM's in the past 5 years or so is making money in silver. 9 years for gold.

Yes there are buy/sell premiums. But if you were careful over the past 5 years you could buy items with low premiums over spot. Or, with the addition of eBay bucks, below spot.

It's not for everyone. But I find a few PM's are an insurance policy of sorts. If I make money that's great. If not no biggie. But I derive some comfort in having that insurance. Peace of mind has value too.

Folks here on NES have been helpful in pointing out good deals, or when there were big rewards with eBay bucks. They helped me learn about the Massachusetts sales tax on PM's and when they apply (although it seems that dealers still apply the rules differently).

Where this will end I don't know. I won't get rich off PM's, nor will I get poor. It's just like I have guns and ammo. Beyond the shooting enthusiast in me there's a bit of knowing I have some level of protection for my family. That's the way I look at PM's too. Yet another layer of protection.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif) . Personally, I'd be buying at $50/ounce.

. Personally, I'd be buying at $50/ounce.

![ROFL [rofl] [rofl]](/xen/styles/default/xenforo/smilies.vb/013.gif)