Varmint

NES Member

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

Be sure to enter the NES/MFS May Giveaway ***Canik METE SFX***

Have the Hunt Brothers come back to life???

I sold everything we had when it hit $40 last time , so missed the last 20% of the run up. Did very well though.

I've sold a little here and there to test the market, and luckily put all the profits (except for my daughter's 1st semester college payment) into gold. I will continue to hedge the rise every now and then, but not really interested in selling big chunks till at least $40ish again.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Gold isn't that far off the all time high at this point.I sold everything we had when it hit $40 last time , so missed the last 20% of the run up. Did very well though.

I've sold a little here and there to test the market, and luckily put all the profits (except for my daughter's 1st semester college payment) into gold. I will continue to hedge the rise every now and then, but not really interested in selling big chunks till at least $40ish again.

I have a Johnson Matthey Hundo available for $2-3 over spot if anyone feels short on weight.

View attachment 374583View attachment 374583View attachment 374584View attachment 374584

If it hits $50 I will sell what I have and wait for it to fall agin before reinvesting. I bought most of my stash between $30-$35.I sold everything we had when it hit $40 last time , so missed the last 20% of the run up. Did very well though.

I've sold a little here and there to test the market, and luckily put all the profits (except for my daughter's 1st semester college payment) into gold. I will continue to hedge the rise every now and then, but not really interested in selling big chunks till at least $40ish again.

that at that time (usually late 1800's I'm looking at) $20 was roughly an ounce of gold.

If it hits $50 I will sell what I have and wait for it to fall agin before reinvesting. I bought most of my stash between $30-$35.

Lots of them here:

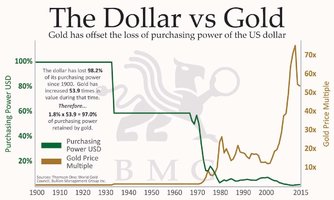

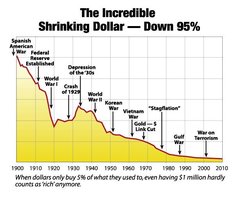

I keep explaining to newbies about the dollar vs silver when you consider you could buy a brand new in the showroom 1963 Impala SS convertible with all the bells and whistles for 3200 US Silver dollars. Those dollars are worth well more than $20 apiece today and if you plowed 1500 to 2K a year to keep that 63 car up to snuff, you would have invested an additional 85K, money out. I'll hold silver thanks and be 60K to the good side.

Here's a couple:

View attachment 374599

View attachment 374600

Silver has been stagnant for so long even with all the FED shenanigans. I just don't have a lot of faith in a big run up anytime in the near future. What is your prediction?

Not stagnant. It was $50 in 2011, dropped to $12, now almost double that, all in 9 years.

dropped to $12, now almost double that, all in 9 years.

Ruh roh, @samandglove1 is selling. Time to liquidate your positions!

Ha. No I’m just going to move a big chunk and get my son something. All my big pieces are $16/oz and below, it’s already performed in roughly a year.

My son bought a boat this year but that's so in him.

You're a good Dad, Ash.

I'm already nostalgic for the $16 silver.

Me too. It was fun to buy a roll of silver eagles for $330 after Ebay bucks. Now it's like $600.

And mining stocks that were $1.50 are now $4. For a bargain shopper it's like shopping at Bass Pro.