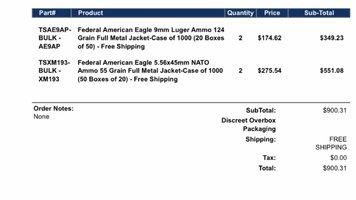

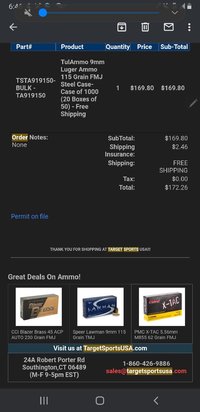

TSUSA was around during SH. I was working in CT for months in 2012 (and the day of SH) and visited their "shop" in Farmington. Ammo stacked to the ceiling in a rather small building. 1 or 2 office people working at a computer just as you walk in. Bought a bunch of 38 spl and 357 magnum from them at that location. This is the google street view of their old location - circled in red....Places like TS and about a half a dozen other remotes that sell ammo didnt even exist during Sandy Hook. (or if they did, I dont remember them). IMHO a lot of these places like TS and

some of the other vendors discussed here, in the past 10 years are basically taking over the role that WalMArt used to occupy for aggressively discounted ammo. "good". I'd rather just click buttons and get what I want

Fast forward to 2016, I was in CT again for work and I visited their new location in Southington - was YUGE! I spoke to the office lady there to pickup some ammo and told her how much they've changed since 2012. She said something along the lines of "yes the last few years have been good to us"....

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

This was a photo I took of their facility in 2016. BIG difference LOL

![Thinking [thinking] [thinking]](/xen/styles/default/xenforo/smilies.vb/010.gif)

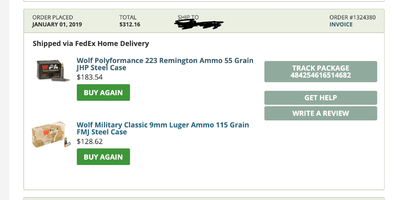

![Thumbs Up [thumbsup] [thumbsup]](/xen/styles/default/xenforo/smilies.vb/044.gif) No need to try to convince me that Russian steel is the same thing as domestic brass.

No need to try to convince me that Russian steel is the same thing as domestic brass. ![Cheers [cheers] [cheers]](/xen/styles/default/xenforo/smilies.vb/018.gif)

![ROFL [rofl] [rofl]](/xen/styles/default/xenforo/smilies.vb/013.gif) Believe whatever you want, though. lol. I just don't think the gas station that can you 5 gallons of gas a week at $1.50 a gallon is a huge influence. Yeah it's a nice treat but it's not making the other gas stations quiver in fear very much. They're not going to cut their prices over it. Walmarts price influence really only mattered when product came back, I can agree that they likely helped burn off sticky price faster. In that short window, dealers actually had to compete with Walmart or they would sell very little. (Walmarts had stock more consistently once demand died off). I can buy into that. Walmart did reduce the amount of Cosby action happening in the margins/transition phases of a panic. Maybe even blocked some "gaming" by distributors in limited cases. But while its actually full retard? Meh.

Believe whatever you want, though. lol. I just don't think the gas station that can you 5 gallons of gas a week at $1.50 a gallon is a huge influence. Yeah it's a nice treat but it's not making the other gas stations quiver in fear very much. They're not going to cut their prices over it. Walmarts price influence really only mattered when product came back, I can agree that they likely helped burn off sticky price faster. In that short window, dealers actually had to compete with Walmart or they would sell very little. (Walmarts had stock more consistently once demand died off). I can buy into that. Walmart did reduce the amount of Cosby action happening in the margins/transition phases of a panic. Maybe even blocked some "gaming" by distributors in limited cases. But while its actually full retard? Meh.