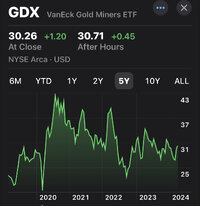

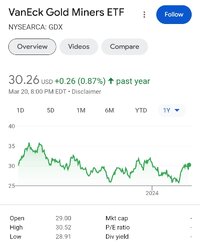

View attachment 863854View attachment 863855

0.87% 1 year

Vs.

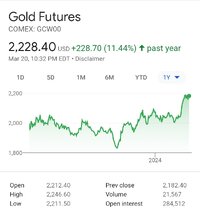

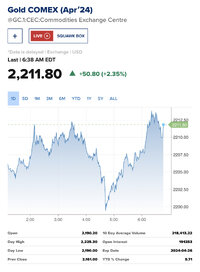

11.44% 1 year

One invests in mining companies / mining businesses / mining equipment/ refining companies " intended to track the overall performance of companies involved in the gold mining industry."

The other is the future commodity contracts / closest thing to Troy ounce.

This is used by insurance and manufacturing companies to secure their contracts ,shipments , orders and insurance on it all. To protect movement in underlying commodity prices throughout manufacturing and shipping. Against price up or down. Forwards, futures , options