He hasn’t told you yet but they were found at @enbloc home.

-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold and silver prices are down

- Thread starter Rider

- Start date

Win

NES Member

Is that 27,500 pounds of silver ![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif) . Did I get that right? How do you make off with that?

. Did I get that right? How do you make off with that?

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif) . Did I get that right? How do you make off with that?

. Did I get that right? How do you make off with that?- Joined

- Sep 10, 2009

- Messages

- 41,857

- Likes

- 79,509

He hasn’t told you yet but they were found at @enbloc home.

Bars of the precious metal were stolen from a shipping container in Montreal, Quebec, on January 2020. Suspects took off with USD$11 million worth of pure silver in bullion form.

Since then, police have partially recovered some of the physical metal in Toronto, British Columbia and Massachusetts, USA.

I'm good. All mine are dated 2017...

- Joined

- Sep 10, 2009

- Messages

- 41,857

- Likes

- 79,509

smokey-seven

NES Member

With trucks and a good forklift.Is that 27,500 pounds of silver. Did I get that right? How do you make off with that?

A local library had two large bronze lions out front on the steps. They both disappeared overnight.

richc

NES Member

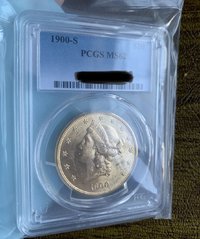

Beautiful coin! They don't make them like they used to...

Will $1800+ hold for more than 30 minutes?

- Joined

- Dec 2, 2016

- Messages

- 3,745

- Likes

- 10,171

absolutelyWill $1800+ hold for more than 30 minutes?

![Smile [smile] [smile]](/xen/styles/default/xenforo/smilies.vb/001.gif)

Varmint

NES Member

Will $1800+ hold for more than 30 minutes?

I hope not, it’s fun to see gold break through $1800 every day.

- Joined

- Sep 10, 2009

- Messages

- 41,857

- Likes

- 79,509

Lank

NES Member

Noob interested in buying gold and silver... any recommendations for vendors? Are coins an easy way to get going?

- Joined

- Sep 10, 2009

- Messages

- 41,857

- Likes

- 79,509

Stay with the Big Metals companies for less exposure to fakes. Be leery of the little eBay sellers or Overseas sellers.Noob interested in buying gold and silver... any recommendations for vendors? Are coins an easy way to get going?

Buy Gold & Silver Bullion Online | Free Shipping - JM Bullion

Precious Metals Dealer | Buy Gold and Silver

Buy Gold Silver Bullion & Coins Online I Lowest Price- SD Bullion

Start with one or two low volume purchases and see if you are treated well and happy with what you receive,

Then set up so that you don't need to use your Credit Card and have an electronic payment method available for the best pricing.

Whenever possible, structure your purchases to take advantage of multiple item purchases. (Example: 1-5 coins equal a higher price point. 6-10 coin purchase offers a buck less per coin; etc.}

You can sometimes do better with a Credit Card if that card offers "Cash Back" benefits, and you are keeping your purchase volume low.

Lastly, take advantage of NES Classifieds by posting a "WTB" offer. Just like firearms, try to buy PM's only from long-standing, well-vetted Green Members with excellent Feedback.

Chances are if they didn't screw someone on a firearms deal, they won't screw you on a Precious Metals deal.

Finally, Be fair and Truthful in all your dealings; and it will be far more Precious than the metals...

~Enbloc

smokey-seven

NES Member

And... don't forget that if you buy from a store front dealer in MA, you will pay sales tax unless you buy over $1,000 at a time.

Varmint

NES Member

And... don't forget that if you buy from a store front dealer in MA, you will pay sales tax unless you buy over $1,000 at a time.

Think that’s true everywhere online too if shipping to Mass. but some vendors do it wrong.

Lank

NES Member

Think that’s true everywhere online too if shipping to Mass. but s

Do on line vendors report purchases to .gov?

Varmint

NES Member

Do on line vendors report purchases to .gov?

If over $10k I think they have to. IRS probably gets the info, and eventually the government will integrate all the data they have on us.

Lank

NES Member

I thought so.If over $10k I think they have to. IRS probably gets the info, and eventually the government will integrate all the data they have on us.

n1oty

NES Member

Think that’s true everywhere online too if shipping to Mass. but some vendors do it wrong.

I can report that JM Bullion does this properly. I always purchase above the $1,000 threshold (average about $2,000 per transaction) and have never had an issue with them regarding inadvertently charging state tax.

- Joined

- Apr 24, 2005

- Messages

- 47,534

- Likes

- 33,582

Bingo. Even dealers have been stuck with fake coins and bars of reasonably high quality.Stay with the Big Metals companies for less exposure to fakes. Be leery of the little eBay sellers or Overseas sellers.

If you are selling privately (NES), the original invoice from a big name like one of those mentioned will make the product much more appealing to the paranoid.

Varmint

NES Member

Gold is $1825, key resistance is $1835.

Was just gonna post that but you beat me to it. Let’s hope it holds!Gold is $1825, key resistance is $1835.

richc

NES Member

And... don't forget that if you buy from a store front dealer in MA, you will pay sales tax unless you buy over $1,000 at a time.

FYI some out of state eBay sellers charge that sales tax as well. Gotta watch for that.

- Joined

- Sep 10, 2009

- Messages

- 41,857

- Likes

- 79,509

My inner paranoid self says, if it's purchased electronically and with a method other than cash, the .Gov can see it if they really want to.Do on line vendors report purchases to .gov?

Walking in with a fist-full of $100's to a local coin/metals store... not so much.

In these times, I'd be less afraid of reporting... than price per ounce and authentic silver or gold content.

Varmint

NES Member

My inner paranoid self says, if it's purchased electronically and with a method other than cash, the .Gov can see it if they really want to.

Walking in with a fist-full of $100's to a local coin/metals store... not so much.

In these times, I'd be less afraid of reporting... than price per ounce and authentic silver or gold content.

- Joined

- Sep 10, 2009

- Messages

- 41,857

- Likes

- 79,509

$$$$$$

Thermo Scientific Niton XL2800 XRF Analyzer Gold Precious Metals XL2 Alloys | eBay

$14,999.00 (used) before tax...

Thermo Scientific Niton XL2800 XRF Analyzer Gold Precious Metals XL2 Alloys | eBay

$14,999.00 (used) before tax...

smokey-seven

NES Member

Many online dealers still rely on you to report sales tax info. I won't say who because technically they are required to charge sales tax for your state of origin.Think that’s true everywhere online too if shipping to Mass. but some vendors do it wrong.

Do on line vendors report purchases to .gov?

Yea, 10 K is the number. SALES to the dealers will get you a 1099 for any number the dealer sees fit to report.If over $10k I think they have to.

It depends on the dealer. Some do, some don't. Ask up front.I always purchase above the $1,000 threshold (average about $2,000 per transaction) and have never had an issue with them regarding inadvertently charging state tax.

I went round and round with eBay on this to the point where I sent them a copy of MA law and they still refused to not charge sales tax. I don't believe it is the out of state dealers that are charging this, it is eBay to the best of my knowledge.FYI some out of state eBay sellers charge that sales tax as well.

richc

NES Member

I went round and round with eBay on this to the point where I sent them a copy of MA law and they still refused to not charge sales tax. I don't believe it is the out of state dealers that are charging this, it is eBay to the best of my knowledge.

If it were an eBay policy it would be consistent across sellers. The rules vary from seller to seller I've found.

If I see sales tax applied where it should not be I just don't buy. Adding 6.25% to the cost of a PM purchase makes it far less desirable.

Share:

Similar threads

- Replies

- 7

- Views

- 99

- Replies

- 11

- Views

- 1K