Varmint

NES Member

Where did it end up?

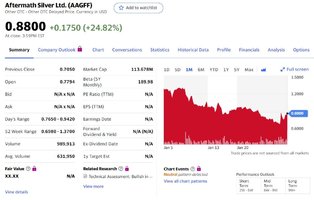

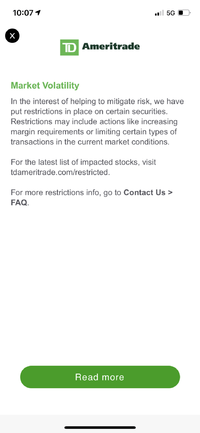

AG yesterday was like $14.8, went as high as $20 in premarket this morning, then ended the day at $16.5, but is now up in after hours. Could be Robinhood locked down the stock, not sure - or maybe WSBers were too busy trying to access their accounts.

AG is only like 25% short, not 140% like GME, so not sure it's gonna be a good short squeeze candidate, also all silver stocks are up so it's a bit hard to tell if AG is up due to WSB or not.

![Cheers [cheers] [cheers]](/xen/styles/default/xenforo/smilies.vb/018.gif)

![ROFL [rofl] [rofl]](/xen/styles/default/xenforo/smilies.vb/013.gif)