Varmint

NES Member

Silver futures are just under $29, which is the August high, and major resistance. Let’s see $30!

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

Be sure to enter the NES/MFS May Giveaway ***Canik METE SFX***

silver sitfolio — Gold Ventures

silver sitfolio, buy and hold portfolio with silver juniorswww.goldventures.org

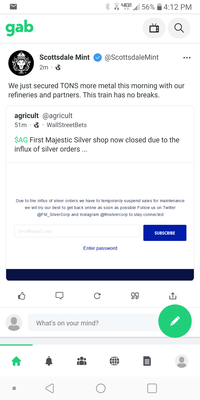

This has been making the rounds, including WSB

I can see one of you guys doing this when silver hits $50 and maybe even dress the part

View attachment 444116

Just don’t drink too much of it!

View attachment 444119

Cant blame them.

![Cheers [cheers] [cheers]](/xen/styles/default/xenforo/smilies.vb/018.gif)

Can someone explain to me in lamens terms why there is such a sudden demand for silver and what the sudden increase in price?

I’m up over 100 grand if that’s the case!Just to let anyone who wants to overpay know SD bullion still has 1oz silver rounds available. Last I checked $36 each.

Can someone explain to me in lamens terms why there is such a sudden demand for silver and what the sudden increase in price?

Just called my guy and he's buying at $1 under spot. I'll be selling a bunch I bought for $15 an ounce to almost double my investment.Checked my local shop. Had to sweet talk for an hour. He deals out of his own inventory exclusively. Said he’s hesitant to sell anything because all of his supply channels are offering him a wait list, at best, where he used to have a replacement order filled in a minute or two. Even places that owe HIM money are saying they have nothing for him in silver right now.

Was able to close a deal after awhile for less than 100oz, $35/ out the door. Maybe I’m buying the top, but I’d rather have the silver than what used to be mattress cash.

Just called my guy and he's buying at $1 under spot. I'll be selling a bunch I bought for $15 an ounce to almost double my investment.

Imo it is sell time not buy time. If it hits $50 I won't feel bad about letting the other guy take some profit. I doubled mine.

.999 BarsWhat kind of silver is it though? 90%? ASEs? Forks and spoons?

Just wondering if a buck under was a good price given the spread/premium on something like an ASE. Bars are probably about right at spot +/- $1.