AlwaysAfter the close on a Friday.

-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

-

Be sure to enter the NES/MFS May Giveaway ***Canik METE SFX***

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold and silver prices are down

- Thread starter Rider

- Start date

kingfisher

NES Member

- Joined

- Oct 22, 2009

- Messages

- 2,626

- Likes

- 2,458

Warren Buffett's Berkshire Hathaway (BRK-A, BRK-B) made a single new stock purchase during the second quarter, snapping up shares of gold miner Barrick Gold Corp (GOLD). It’s a surprising move for the “Oracle of Omaha” who’s long dismissed the precious metal as an attractive investment...

<snip>

What's more, Buffett has often dismissed the idea of gold as a good store of value.

"I would say that gold would be way down on my list as a store of value," Buffett said at the 2005 annual meeting. "I mean, I would prefer owning a hundred acres of land near here in Nebraska, or an apartment house, or an index fund."

Warren Buffett and Charlie Munger have a history of trashing gold

Varmint

NES Member

Crazy stuff, the only reason it's hard to celebrate is that the S&P500 is also near an all time high. That seems very sketchy.

You need some vintage cast iron.I’m still eating the 140+ pounds of deer I killed last year so I’m not too focused on meat prices

Back straps for dinner tonight

View attachment 381378

![Wink [wink] [wink]](/xen/styles/default/xenforo/smilies.vb/002.gif)

We’ve been in a different dimension since March.Crazy stuff, the only reason it's hard to celebrate is that the S&P500 is also near an all time high. That seems very sketchy.

Varmint

NES Member

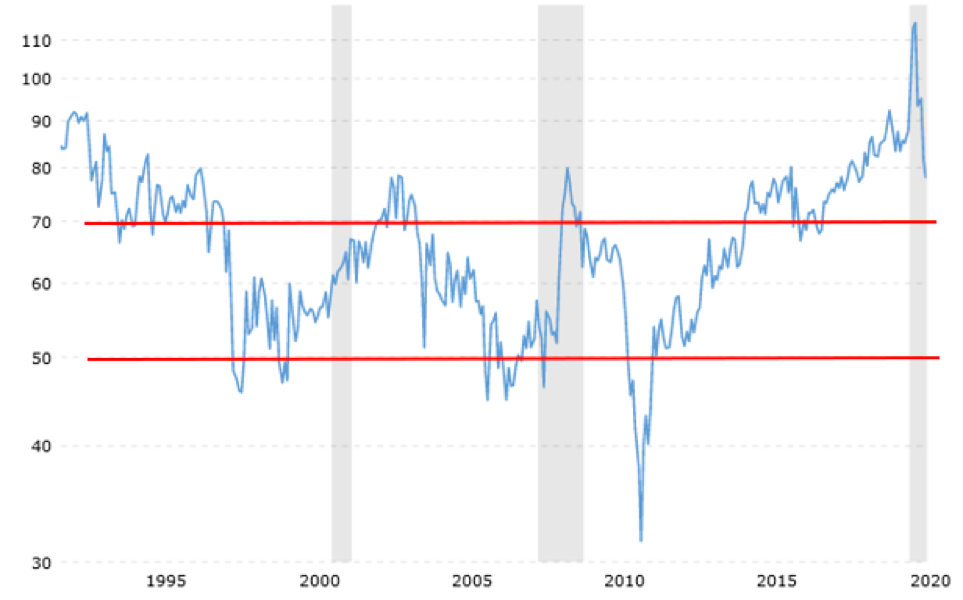

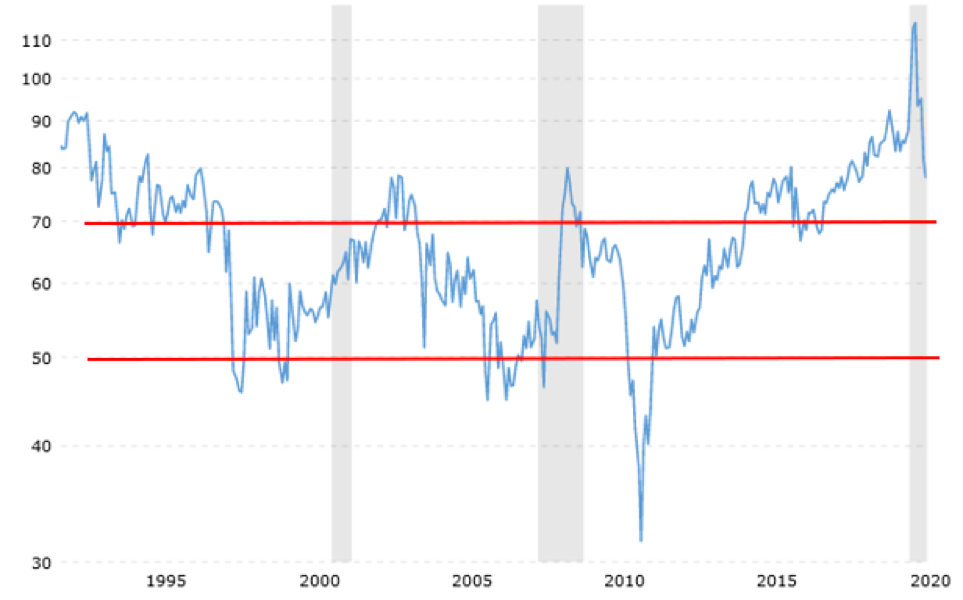

Silver's got plenty of room to move.

Gold to silver ratio still historically high.

If gold goes to $2500 and silver behaves like the 2011 peak, it'll go to $75. But I think gold will go to $5000, so silver may peak out at $150.

I think short term we will retest the breakout levels. $1800 gold, $18 silver.

Gold to silver ratio still historically high.

If gold goes to $2500 and silver behaves like the 2011 peak, it'll go to $75. But I think gold will go to $5000, so silver may peak out at $150.

I think short term we will retest the breakout levels. $1800 gold, $18 silver.

Last edited:

It’s a wonder to behold Chris. I’m glad I got into those silver juniors so heavily about 2-3 months ago. It would have been better if back in early Feb/Mar. but we can’t always be on point 100% of the time.Silver's got plenty of room to move.

Gold to silver ratio still historically high.

If gold goes to $2500 and silver behaves like the 2011 peak, it'll go to $75. But I think gold will go to $5000, so silver may peak out at $150.

I think short term we will retest the breakout levels. $1800 gold, $18 silver.

Win

NES Member

Curious - why do you think PMs will move back down in the short term? Thanks!I think short term we will retest the breakout levels. $1800 gold, $18 silver.

The only reason I can see why would be so the banks, the rich, and the shameless can short to buy in low.Curious - why do you think PMs will move back down in the short term? Thanks!

Varmint

NES Member

Curious - why do you think PMs will move back down in the short term? Thanks!

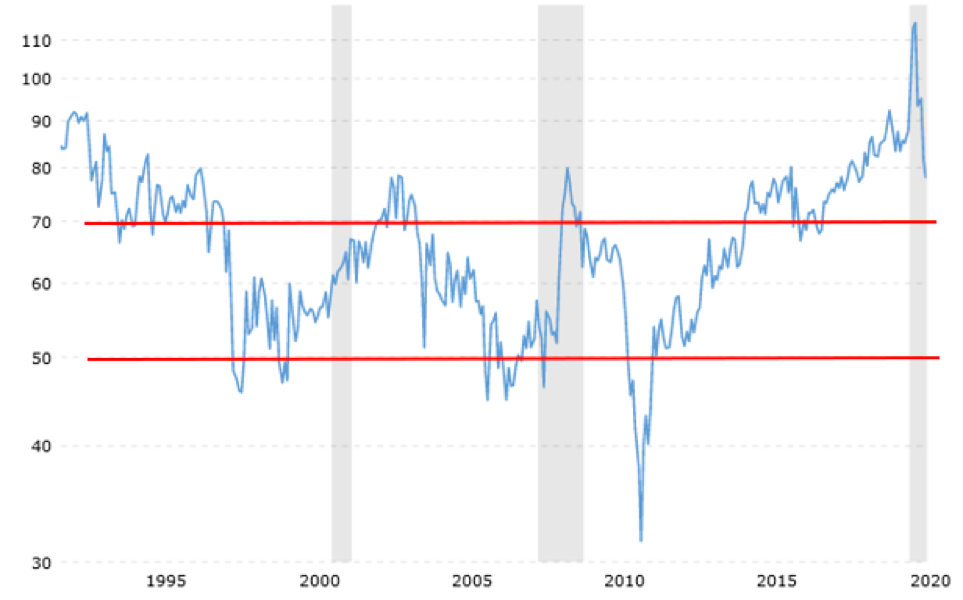

Just that every investment follows trading patterns, both are extreme overbought, and everyone who wants to buy at these prices has bought. The positive news coming (Congressional stimulus, Fed dovishness) is all priced in already, so there aren't any drivers to push it up higher. You should see profit taking and a lack of bids. You saw the same thing in every past bull market for PMs.

I know people point to Buffett buying, but he didn't buy this week, he was buying last quarter. Much of the gain is due to the slide in the dollar, which I think may have temporarily bottomed. Nothing moves in one direction forever. PMs have moved up like 9 weeks in a row, that doesn't happen forever.

There's a ton of money buying on every little pullback, which is why we haven't corrected. When enough people have bought the dips, you'll run out of dip buyers and have a real correction.

So I'm not a seller of PMs or core mining stocks, but I'm not a buyer at these prices either.

Varmint

NES Member

The only reason I can see why would be so the banks, the rich, and the shameless can short to buy in low.

Yeah, there's a lot of people who thinks the bullion banks drive down prices, and I'm sure they try, but not sure they're very successful, especially these days.

Well, I hope you’re wrong on the immenent correction.Yeah, there's a lot of people who thinks the bullion banks drive down prices, and I'm sure they try, but not sure they're very successful, especially these days.

Win

NES Member

Thanks for the insight. I'm always buying when my budget allows it ![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Let me play contrarian for a brief moment and say I think we may never know how many buyers are left in this market. How can we quantify them? I think what may play out is some serious turn of events that drives people away from stocks in general and to all things physical when and if the dollar suddenly falls dead with all other fiats. At that point, which may not be too far ahead, there’ll be something totally new in store.Just that every investment follows trading patterns, both are extreme overbought, and everyone who wants to buy at these prices has bought. The positive news coming (Congressional stimulus, Fed dovishness) is all priced in already, so there aren't any drivers to push it up higher. You should see profit taking and a lack of bids. You saw the same thing in every past bull market for PMs.

I know people point to Buffett buying, but he didn't buy this week, he was buying last quarter. Much of the gain is due to the slide in the dollar, which I think may have temporarily bottomed. Nothing moves in one direction forever. PMs have moved up like 9 weeks in a row, that doesn't happen forever.

There's a ton of money buying on every little pullback, which is why we haven't corrected. When enough people have bought the dips, you'll run out of dip buyers and have a real correction.

So I'm not a seller of PMs or core mining stocks, but I'm not a buyer at these prices either.

Win

NES Member

Dollar is also falling daily which is why I'de prefer to hold PMs. Obviously I hold some dollars in case I need immediate liquidity but for money I'm holding for 6 month or greater liquidity I'd rather hold PMs.

I agree. I have cash stored as well.Dollar is also falling daily which is why I'de prefer to hold PMs. Obviously I hold some dollars in case I need immediate liquidity but for money I'm holding for 6 month or greater liquidity I'd rather hold PMs.

So I'm not a seller of PMs or core mining stocks, but I'm not a buyer at these prices either.

I agree with everything you say here, but (while I am also not a buyer right now) I do believe in testing the local demand and price points (I am only talking about physical PM’s). I like to occasionally sell off approx 50-100 oz of AG and 1-2 oz of AU to private people or dealers when my metals are comfortably in the money, just to give myself a reality check as to what people are willing to pay in cash. Besides putting a little $$ in my pocket, this anecdotal info helps me solidify relationships with the buyers for the majority of my physical PM’s in the future. I don’t want to be limited to selling online (Facebook, Reddit, Instagram, etc...) to get the best prices when it’s time for me to exit my positions.

I may be losing a little upside in the future, but I protect myself from the dangers of holding everything and potentially watching prices eventually retreat. This strategy isn’t for everyone, but it has worked for me during the last two run ups. As always, free advice from an informed source should be heard, but not necessarily followed. Cheers.

richc

NES Member

I agree with everything you say here, but (while I am also not a buyer right now) I do believe in testing the local demand and price points (I am only talking about physical PM’s). I like to occasionally sell off approx 50-100 oz of AG and 1-2 oz of AU to private people or dealers when my metals are comfortably in the money, just to give myself a reality check as to what people are willing to pay in cash. Besides putting a little $$ in my pocket, this anecdotal info helps me solidify relationships with the buyers for the majority of my physical PM’s in the future. I don’t want to be limited to selling online (Facebook, Reddit, Instagram, etc...) to get the best prices when it’s time for me to exit my positions.

I may be losing a little upside in the future, but I protect myself from the dangers of holding everything and potentially watching prices eventually retreat. This strategy isn’t for everyone, but it has worked for me during the last two run ups. As always, free advice from an informed source should be heard, but not necessarily followed. Cheers.

Ash,

In your experience where's the best place(s) to sell to maximize your investment?

Thx

Rich

Rich- I’m usually only interested in cash buyers. I have 5-10 private people (or investment clubs) that I keep a relationship with. I price things lower than dealers (but always a decent % over spot), so buyers get a better deal than full retail. Most of them are guys wanting to hedge against something (inflation, currency devaluation, apocalypse, etc...), but some just want to get a good deal from someone trustworthy and is discreet.

There are also a few dealers that always need inventory (especially premium pieces like ASE’s, Engelhard/JM, PAMP, etc...) and don’t want to pay rapey distributor prices. They will pay in cash and they sell for cash to their customers. A few good ones are in NH, but there are some locally to us.

I can give you a more details at the club sometime.

There are also a few dealers that always need inventory (especially premium pieces like ASE’s, Engelhard/JM, PAMP, etc...) and don’t want to pay rapey distributor prices. They will pay in cash and they sell for cash to their customers. A few good ones are in NH, but there are some locally to us.

I can give you a more details at the club sometime.

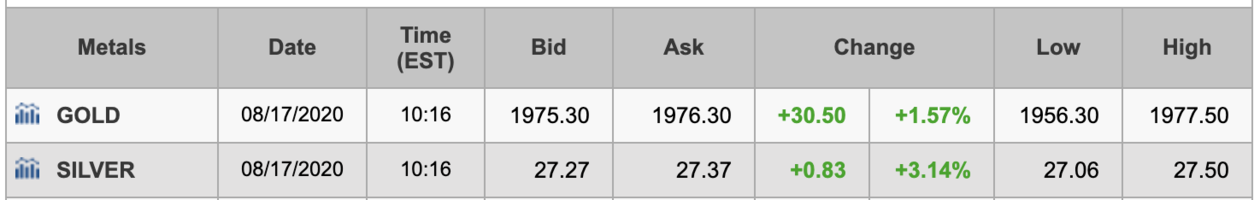

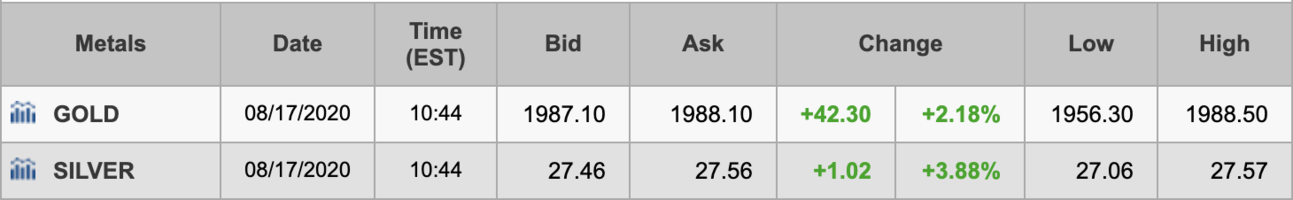

IMHO gold crawling back over $2000/oz for the second time is more significant than the first move. It shows there is real demand and commitment behind this rally.

View attachment 381664

I agree... the fact that its going above 2000 so quickly is a good sign. 2100 will be hit very soon, and normally, I think it would hit a correction at that mile mark, but I don't think so this time.

Varmint

NES Member

I agree with everything you say here, but (while I am also not a buyer right now) I do believe in testing the local demand and price points (I am only talking about physical PM’s). I like to occasionally sell off approx 50-100 oz of AG and 1-2 oz of AU to private people or dealers when my metals are comfortably in the money, just to give myself a reality check as to what people are willing to pay in cash. Besides putting a little $$ in my pocket, this anecdotal info helps me solidify relationships with the buyers for the majority of my physical PM’s in the future. I don’t want to be limited to selling online (Facebook, Reddit, Instagram, etc...) to get the best prices when it’s time for me to exit my positions.

I may be losing a little upside in the future, but I protect myself from the dangers of holding everything and potentially watching prices eventually retreat. This strategy isn’t for everyone, but it has worked for me during the last two run ups. As always, free advice from an informed source should be heard, but not necessarily followed. Cheers.

Yeah totally- APMEX is asking $40 for ASEs, if you can sell around that price that's a great opportunity. I don't really have the time to do that but it's certainly a great strategy to sell into such crazy demand.

richc

NES Member

Rich- I’m usually only interested in cash buyers. I have 5-10 private people (or investment clubs) that I keep a relationship with. I price things lower than dealers (but always a decent % over spot), so buyers get a better deal than full retail. Most of them are guys wanting to hedge against something (inflation, currency devaluation, apocalypse, etc...), but some just want to get a good deal from someone trustworthy and is discreet.

There are also a few dealers that always need inventory (especially premium pieces like ASE’s, Engelhard/JM, PAMP, etc...) and don’t want to pay rapey distributor prices. They will pay in cash and they sell for cash to their customers. A few good ones are in NH, but there are some locally to us.

I can give you a more details at the club sometime.

Funny how cash is still king. But IMHO it's now more a medium of exchange than something to hold for the long term.

Why do many of us hold some AU and AG? To diversify from the US dollar. What do we exchange the the AU and AG for? The US dollar.

Just found this an interesting dichotomy.

Varmint

NES Member

Let me play contrarian for a brief moment and say I think we may never know how many buyers are left in this market. How can we quantify them? I think what may play out is some serious turn of events that drives people away from stocks in general and to all things physical when and if the dollar suddenly falls dead with all other fiats. At that point, which may not be too far ahead, there’ll be something totally new in store.

The problem is that PMs have been closely tracking the stock market, so any pullbacks in the S&P500 are likely to bring down the metals and in particular mining stocks.

I don't like to be tied at the hip to the S&P500 cause I think it's in a Wile E Coyote moment.

There are a lot of things that should not be so high, like the Euro. That's partly why the dollar is weak and it makes no sense.

So even though the fundamentals for PMs are fantastic, the reason they have run up so much is actually not due to fundamentals, it's trend following euphoria, and that may not last. Although it seems to go on forever in things like Tesla and Apple so who knows.

not new guy

NES Member

- Joined

- Dec 7, 2009

- Messages

- 36,117

- Likes

- 54,403

The price is also still (sort of) controlled by the futures market.

Well, if you think the trend is higher for the metals and miners, you can use this current weakness to establish some call positions on your favorite miners perhaps. Let's say you like Hecla Mining (HL; $6.08 ask, as I type). You can buy 1000 shares for $6080ish or for $1830ish (less than 1/3 the cost) you can buy 10 contracts of the 18 Dec 2020 $5.00 call on Hecla. You will not be a shareholder of Hecla, but you have the "right to buy" 1000 shares of Hecla at $5 a share through 18 Dec 2020.

If HL drops to $5 or less at expiration (18 Dec) and you do nothing, this position will expire worthless. Net loss: $1830ish.

If you purchased the stock at $6.08 and HL drops to $5 at expiration, you will have an unrealized loss of $1.08 per share or $1080; but you are still a shareholder.

If HL is trading at $10 by expiration, you can now exercise your right to buy at $5 a share (adjusted cost is $6.83 per share). You may also close your option position by selling the 18 Dec $5 calls, which will have an intrinsic value of $5, at a minimum. $5000 relative to $1830 is +173%

Your stock position is $10000 relative to $6080 for 64% gain.

Peace.

Don't be fooled, option buyers often lose money. Option buyers can lose 100% of their investment. Unlike margin accounts, where you can lose more than 100%, option purchases can be done in a "cash" account.

And now for something completely different ...

www.kitco.com

www.kitco.com

If HL drops to $5 or less at expiration (18 Dec) and you do nothing, this position will expire worthless. Net loss: $1830ish.

If you purchased the stock at $6.08 and HL drops to $5 at expiration, you will have an unrealized loss of $1.08 per share or $1080; but you are still a shareholder.

If HL is trading at $10 by expiration, you can now exercise your right to buy at $5 a share (adjusted cost is $6.83 per share). You may also close your option position by selling the 18 Dec $5 calls, which will have an intrinsic value of $5, at a minimum. $5000 relative to $1830 is +173%

Your stock position is $10000 relative to $6080 for 64% gain.

Peace.

Don't be fooled, option buyers often lose money. Option buyers can lose 100% of their investment. Unlike margin accounts, where you can lose more than 100%, option purchases can be done in a "cash" account.

And now for something completely different ...

Robert Kiyosaki on why the U.S. may no longer be a free country

Robert Kiyosaki on why the U.S. may no longer be a free country (Pt. 1/2)

www.kitco.com

www.kitco.com

Last edited:

Share:

Similar threads

- Replies

- 7

- Views

- 103