-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

-

Be sure to enter the NES/MFS May Giveaway ***Canik METE SFX***

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold and silver prices are down

- Thread starter Rider

- Start date

Varmint

NES Member

Miners have been consolidating all week - we might get a nice pop tomorrow if gold and silver can finish the week strong.

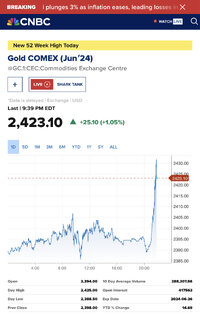

$2430 new ath yet again. Nikkei dumps 3%. Wut is going on?

Varmint

NES Member

Reports of explosions in Iran.

Yup. Noticed that almost immediately after I checked my sitreps.Reports of explosions in Iran.

Varmint

NES Member

Iran has lifted air restrictions so maybe this was a nothing burger.

richc

NES Member

A very good read:

www.profstonge.com

www.profstonge.com

Gold Prices are on Fire

In case you've been living under a rock, Gold prices have been on fire, jumping 20% in just the past 2 months. That takes gold to a near-doubling since pre-pandemic, when it was meandering along at just $1500. Yesterday it closed above 2400. So if you don't own any gold, it might make sense to...

Palladin

NES Member

Airline worker among six arrested in $22M airport gold heist. Police say it was an inside job

Six people have been arrested in last year’s multimillion-dollar gold heist at Toronto’s Pearson International Airport, police in Canada and the US said Wednesday.

Ban gold! Save the children!

Airline worker among six arrested in $22M airport gold heist. Police say it was an inside job

Six people have been arrested in last year’s multimillion-dollar gold heist at Toronto’s Pearson International Airport, police in Canada and the US said Wednesday.www.yahoo.com

Varmint

NES Member

I don't think this chart is valid but it's certainly interesting.

I’ll take a refill thank you.I don't think this chart is valid but it's certainly interesting.

Varmint

NES Member

I’ll take a refill thank you.

I can’t wait another 31 years to refill the cup!

~$2,250,000, the new alchemy, turning oil into AU

I sold my position and haven't been allowed to open a new position (due to illiquid volume, so they say). Bummer!FTCO up +8.57% today @NavelOfficer

FWIW, there were long lines at many of the gold stores in Bangkok the other day, but none of these stores are interested in buying Maple Leafs, Eagles or Krugerrands.

Last edited:

Varmint

NES Member

I sold my position and haven't been allowed to open a new position (due to illiquid volume, so they say). Bummer!

FWIW, there were long lines at many of the gold stores in Bangkok the other day, but none of these stores are interested in buying Maple Leafs, Eagles or Krugerrands.

They said the same thing in Argentina, gold shops want jewelry not coins or bars. I guess they can resell jewelry and maybe better markup?

That’s my guess as well. Lowball scrap and jewelry to refine and/or resell.They said the same thing in Argentina, gold shops want jewelry not coins or bars. I guess they can resell jewelry and maybe better markup?

Varmint

NES Member

That’s my guess as well. Lowball scrap and jewelry to refine and/or resell.

Yeah the markup on gold jewelry is huge.

Why today's pullback?

richc

NES Member

Why today's pullback?

Easing of tensions between Israel and Iran.

If Israel had dropped a nuke on Iran we'd all be rolling in dough...

That's all I can think. Kind of thought that was already priced in. Guess I was wrong.Easing of tensions between Israel and Iran.

Also a rotation back into stocks.

richc

NES Member

The same thing when gold was bouncing up near 2000 and trying to cross it. There was a big downdraft when the price failed to pierce the $2000 mark. Down into the mid $1800 IIRC.

Gold will go up, until it goes down. But the fundamental story hasn't changed.

Gold will go up, until it goes down. But the fundamental story hasn't changed.

One part of me is hoping this is the correction we’ve been waiting for back down to $2100 before the final move to infinity. If not we still need that resistance tested to confirm the breakout for miners.

Varmint

NES Member

Why today's pullback?

Gold is way overbought, correction is needed.

Varmint

NES Member

One part of me is hoping this is the correction we’ve been waiting for back down to $2100 before the final move to infinity. If not we still need that resistance tested to confirm the breakout for miners.

Don’t think it’ll go that low. $2250 maybe. We’re in a gold breakout so pullbacks will be short and mild.

Varmint

NES Member

The same thing when gold was bouncing up near 2000 and trying to cross it. There was a big downdraft when the price failed to pierce the $2000 mark. Down into the mid $1800 IIRC.

Gold will go up, until it goes down. But the fundamental story hasn't changed.

Totally different. $2000 was major multi year resistance, as was $2100. There’s no resistance above $2100, so gold blew straight to $2450, which was the first Fibonacci target of the decade long cup and handle. This is just an overbought pullback. Don’t try to correlate gold’s moves with news, this is a technical breakout - momentum trading and profit taking are driving the price.

Gold’s behavior in a bull market is very different from its behavior in a bear market. We’ve been in a bear market for so long it’s hard to change mentality.

Share:

Similar threads

- Replies

- 7

- Views

- 103