Grendizer138

NES Member

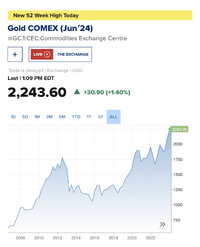

The Manchester coin expo is this weekend, so it was completely predictable that PM would explode recently. The only thing I’m sure of is if I do buy some tomorrow there will be a correction Monday.We are at the point in this PM run where I get FOMO, buy as much as I can reasonably afford, and then we get a pullback![Thumbs Up [thumbsup] [thumbsup]](/xen/styles/default/xenforo/smilies.vb/044.gif)