No, option values are based on intrinsic value and time value. The more the option is in the money, the greater the intrinsic value. Time value is hard to price, but is generally greater when there is more time remaining on your contracts.Cool, so if the option gains $0.41 does that mean AG went to $7.41, or not really?

I guess it’s like futures traders, they don’t want the metal just to make money on the trade. Thank you for the explanation.![Thumbs Up [thumbsup] [thumbsup]](/xen/styles/default/xenforo/smilies.vb/044.gif)

-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold and silver prices are down

- Thread starter Rider

- Start date

You can place a limit order on your option. If it hits that bid/ask (depending on what you're doing) price, your order should fill Of course, you may get a partial fill, if it's a large order. If I wanted to buy those calls at 50¢ (post #8575), I could use a limit order, but it may not fill today.Another question I was wondering is can you set buy orders for options that get triggered in a day or week at a certain price? Or do you have to manage it daily?

It looks as though we would have been filled at 50¢, had we placed a limit order, as that's the current ask. Again, most MMs are only obligated to fill one contract, all if available or if you designate AON, etc.

Good luck.

Characteristics and Risks of Standardized Options

Last edited:

Win

NES Member

My platinum has made a nice little run but I’m not sure why it’s perked up. Anyone here anything?

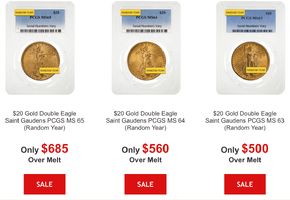

Maybe a stupid question, but here goes: If you were to sell this back to JM Bullion, or anyone else, would they give you spot times the 0.2354 weight? Or, would they give you spot times 0.2158 (which is 0.2354 times the purity of 0.9167)?I used that opportunity to grab a couple of these this morning. They don’t seem to ever launch sales when spot is low. But the sales often stay active if the spot drops. But now we are already above $2,000 again so need to keep an eye out for these drops.

Buy Gold & Silver Bullion Online | Free Shipping - JM Bullion

richc

NES Member

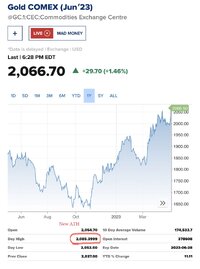

Oh look, someone is dumping huge volumes of gold at 3-4 am, driving it below $2000, haven’t seen that before.

It wasn't me. I don't get up that early...

HappyHarry

NES Member

The coins weigh about 8 grams total at .916 (22k) purity, which gives an actual fine gold weight of .2354 troy ounces.Maybe a stupid question, but here goes: If you were to sell this back to JM Bullion, or anyone else, would they give you spot times the 0.2354 weight? Or, would they give you spot times 0.2158 (which is 0.2354 times the purity of 0.9167)?

richc

NES Member

Varmint

NES Member

Maybe a stupid question, but here goes: If you were to sell this back to JM Bullion, or anyone else, would they give you spot times the 0.2354 weight? Or, would they give you spot times 0.2158 (which is 0.2354 times the purity of 0.9167)?

I don’t think they calculate it that way, they probably just adjust the premium per coin up and down. Spot is just a useful reference for you since it has no numismatic value.

Varmint

NES Member

Varmint

NES Member

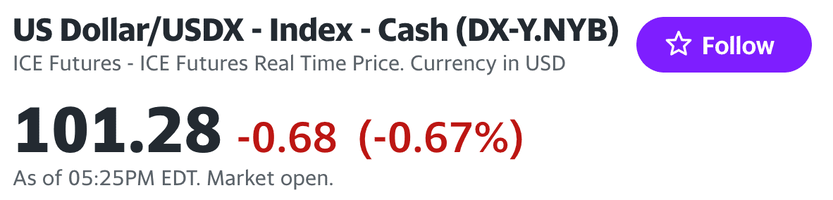

Gold closes the month at $1999.40, no shenanigans there. ![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

The longer we hang around $2000 without failing and returning to $1900, the more $2000 becomes a new floor.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

The longer we hang around $2000 without failing and returning to $1900, the more $2000 becomes a new floor.

Varmint

NES Member

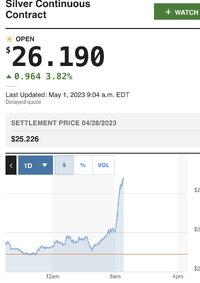

Nice monthly close on silver at $25.33. ![Thumbs Up [thumbsup] [thumbsup]](/xen/styles/default/xenforo/smilies.vb/044.gif)

![Thumbs Up [thumbsup] [thumbsup]](/xen/styles/default/xenforo/smilies.vb/044.gif)

Varmint

NES Member

Varmint

NES Member

413dan

NES Member

I was curious what silver monster boxes were priced at these days. 6k difference between maples and eagles. Nuts. 16.7k and 22.7k respectively as of writing. That was on APMEX so albeit sometimes a bit higher than others, but damn.

I’ll consider myself lucky that I don’t have much wealth to protect, I guess?!?!I was curious what silver monster boxes were priced at these days. 6k difference between maples and eagles. Nuts. 16.7k and 22.7k respectively as of writing. That was on APMEX so albeit sometimes a bit higher than others, but damn.

HappyHarry

NES Member

Current buy price from a large national dealer:I was curious what silver monster boxes were priced at these days. 6k difference between maples and eagles. Nuts. 16.7k and 22.7k respectively as of writing. That was on APMEX so albeit sometimes a bit higher than others, but damn.

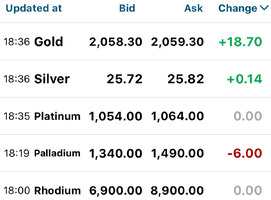

Attachments

richc

NES Member

Current buy price from a large national dealer:

@HappyHarry , an ounce of silver is an ounce of silver. Why the huge markup on these?

thx

Rich

Varmint

NES Member

Current buy price from a large national dealer:

Sale price, or price they're offering for your silver?

HappyHarry

NES Member

Price they're offeringSale price, or price they're offering for your silver?

HappyHarry

NES Member

I guess just simple supply and demand. Lots of people are willing to pay crazy premiums for silver eagles. There are much cheaper ways to buy for just the silver value. Also, these are heavily marketed, especially on TV, to people who just don't know any better.

smokey-seven

NES Member

If I recall correctly, all silver to be used in eagle production has to come from US suppliers, be mined and processed here and the rounds are then sold to the mint. If the mint could buy rounds from Canada then the price would reflect the Canadian price more closely.I guess just simple supply and demand. Lots of people are willing to pay crazy premiums for silver eagles.

Here’s hoping.

Varmint

NES Member

Says gold day high was $2085 after hours.

Oh yup, thanks DJB

Oh yup, thanks DJB

Share:

Similar threads

- Replies

- 7

- Views

- 99

- Replies

- 11

- Views

- 1K