Is that out at 8:30am?PMs and their miners keep hanging around, let’s get it over with and punch through $2100.

Tomorrow’s CPI could be the catalyst if it’s below expectations. High CPI would mean the Fed has to keep raising rates, bad for gold.

-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

-

Be sure to enter the NES/MFS May Giveaway ***Canik METE SFX***

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold and silver prices are down

- Thread starter Rider

- Start date

Varmint

NES Member

Is that out at 8:30am?

Yes, market is expecting 5.2% vs 6.0% for February.

- Joined

- Apr 24, 2005

- Messages

- 47,588

- Likes

- 33,692

Not only are PMs denied federal capital gains tax treatment, but the gains are taxes as 12% MA collectible gains - more that twice the ordinary income rate. Between the taxes and the buy at retail/sell below wholesale spread you need a large percentage gain to make it worthwhile. Of course, there are benefits of unregistered and off books assets, or post-apocalypse prep, if you are into that sort of thing.

Varmint

NES Member

Not only are PMs denied federal capital gains tax treatment, but the gains are taxes as 12% MA collectible gains - more that twice the ordinary income rate. Between the taxes and the buy at retail/sell below wholesale spread you need a large percentage gain to make it worthwhile. Of course, there are benefits of unregistered and off books assets, or post-apocalypse prep, if you are into that sort of thing.

Or you could use a PM IRA, I hear about those but don’t know if they are popular. My physical PMs are heir looms, no plan to sell them, and my investments are in miners not the metals themselves.

Spot price moving up ahead of the report. Could be interesting to see what the cpi is at 8:30a.

Am I the only one here that doesn’t want the price of gold to go up? I mean, sure we could cash in on our PM’s, but our dollars won’t be worth the paper they’re printed on.Spot price moving up ahead of the report. Could be interesting to see what the cpi is at 8:30a.

The only thing I'm going to be seeing at 8:30am is the inside of my eyelids.

Varmint

NES Member

Gold and silver way up overnight, but so are interest rates. That doesn’t make a lot of sense unless maybe gold and silver are finally starting to get the attention of generalist investors and momentum traders?

Varmint

NES Member

Am I the only one here that doesn’t want the price of gold to go up? I mean, sure we could cash in on our PM’s, but our dollars won’t be worth the paper they’re printed on.

I was that way for a while but now I’m fully invested in PM miners so bring it on.

![Popcorn [popcorn] [popcorn]](/xen/styles/default/xenforo/smilies.vb/043.gif)

Grendizer138

NES Member

No, I’ve brought that up before and it’s why physical PM investors and investors of futures and mining stocks shouldn’t mingle. In general, unless you’re completely invested in PM you are losing somewhere else as your PM increases in value.Am I the only one here that doesn’t want the price of gold to go up? I mean, sure we could cash in on our PM’s, but our dollars won’t be worth the paper they’re printed on.

I buy PM as a hedge/insurance policy, and I hope that the physical PM I buy now is worth exactly what I bought it for in twenty years.

Win

NES Member

It's been difficult for me to pick PM miners and companies. I don't know very much about the business, drilling, country laws, country risks, many things to consider. So...what I've done instead is to watch all the PM and PM mining investing shows I can and buy the companies that are mentioned by different people on different shows. What I can say is, that at least thus far, I'm way up against my bank account savings rate.

Varmint

NES Member

No, I’ve brought that up before and it’s why physical PM investors and investors of futures and mining stocks shouldn’t mingle. In general, unless you’re completely invested in PM you are losing somewhere else as your PM increases in value.

I buy PM as a hedge/insurance policy, and I hope that the physical PM I buy now is worth exactly what I bought it for in twenty years.

Investors (not traders) in miners usually have physical PMs already. If they don’t, they don’t understand what they’re investing in.

Varmint

NES Member

It's been difficult for me to pick PM miners and companies. I don't know very much about the business, drilling, country laws, country risks, many things to consider. So...what I've done instead is to watch all the PM and PM mining investing shows I can and buy the companies that are mentioned by different people on different shows. What I can say is, that at least thus far, I'm way up against my bank account savings rate.

I have two paid newsletters (4 in the past) but the best mining stock investment I ever made (Great Bear) I got through mining podcasts like that. None of the newsletters had recommended it.

Great Bear paid for the dogs the paid newsletters gave me.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Win

NES Member

I have some money in Schiff's foreign dividend paying stock mutual fund - EPIVX. After that it's nearly all gold funds, stocks, and physical. JMHO...It's time to be bold gold.

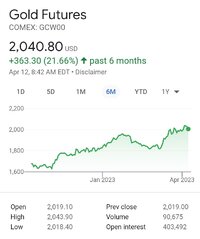

All Time High today for GOLD !!!!!

BTW, this is a sign that people are not feeling good about the stock market (recession will occur around Q4 '23) this also means people are not happy with the corrupt government & corrupt banks etc...

Major difference between a Gold Fund or Gold Stock that isn't backed by gold and is in the business of exploration. Be very careful. Maybe of the wildcat stocks go bust. If anyone would know it would be me.I have some money in Schiff's foreign dividend paying stock mutual fund - EPIVX. After that it's nearly all gold funds, stocks, and physical. JMHO...It's time to be bold gold.

Especially with small market cap, like the mining stocks. Especially penny stocks with small volumes.

I like Schiff but he is also wrong half the time... be careful of anyone who tries to create FEAR, Then offer to sell you the solution

I'm just happy that silver is also up

Varmint

NES Member

BTW, this is a sign that people are not feeling good about the stock market (recession will occur around Q4 '23) this also means people are not happy with the corrupt government & corrupt banks etc...

Of course there are some gold buyers with those motivations, but look at the overall market, everything is reacting to low CPI which means less hawkish Fed and maybe the end of rate hikes. Stocks up, interest rates down, gold and silver up. It's Fed policy that's what's driving gold and everything else.

Varmint

NES Member

All Time High today for GOLD !!!!!

I don’t know how you come to that conclusion but don’t feel like arguing.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Just prove me wrong. Show me I'm wrongI don’t know how you come to that conclusion but don’t feel like arguing.![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Varmint

NES Member

Major difference between a Gold Fund or Gold Stock that isn't backed by gold and is in the business of exploration. Be very careful. Maybe of the wildcat stocks go bust.

I wish that were true - despite the brutal bear market in gold stocks, most of the crap lifestyle companies managed to hang around, plus they will rocket up if we get into a FOMO bull market for gold stocks. in such a market the crappy stocks can outperform the good ones.

![Puke2 [puke2] [puke2]](/xen/styles/default/xenforo/smilies.vb/031.gif)

Varmint

NES Member

Just prove me wrong. Show me I'm wrong

Google gold all time high. You'll get a lot of numbers, all of them higher than $2040.

You're quoting some pre-market futures price, are you saying it's the all time pre-market high?

richc

NES Member

It's been difficult for me to pick PM miners and companies. I don't know very much about the business, drilling, country laws, country risks, many things to consider. So...what I've done instead is to watch all the PM and PM mining investing shows I can and buy the companies that are mentioned by different people on different shows. What I can say is, that at least thus far, I'm way up against my bank account savings rate.

Don't invest in anything you don't fully understand.

Win

NES Member

I know, I know. I can't help myself. I have watched a lot of interviews about the mining sector and stocks and found them persuasive. The small investments I've made have done well. But, yes, you're right, significant chance of losing money.Don't invest in anything you don't fully understand.

Varmint

NES Member

I know, I know. I can't help myself. I have watched a lot of interviews about the mining sector and stocks and found them persuasive. The small investments I've made have done well. But, yes, you're right, significant chance of losing money.

You don’t have to be a geologist to invest in mining stocks, or a mining expert. In fact look at the investing pros, few of them have beaten the dumb indexes the last 13 years.

I think it’s more important to understand investor psychology and have a basic understanding of the macro forces, and these days, the Fed seems to be all that matters.

You probably know a lot about mining stocks from listening to experts, the only problem is they tend to not name specific companies. Some of them literally never name a specific company. My favorite guy, Dave Erfle, has no problem naming a favorite stock once his subscribers have had a chance to get in it.

After a while you get a feel for who is legit and who is just promoting companies.

- Joined

- Dec 25, 2009

- Messages

- 2,146

- Likes

- 446

1) Does anyone know of a source for the CPI data calculated the way they did before they recently changed it?

2) Comparing the rate of change to a rate of change from last year seems disingenuous on top of changing how it is calculated?

3) Look at the rate of change is interesting considering that prices are going up even if the "rate of growth has slowed"

2) Comparing the rate of change to a rate of change from last year seems disingenuous on top of changing how it is calculated?

3) Look at the rate of change is interesting considering that prices are going up even if the "rate of growth has slowed"

Varmint

NES Member

1) Does anyone know of a source for the CPI data calculated the way they did before they recently changed it?

2) Comparing the rate of change to a rate of change from last year seems disingenuous on top of changing how it is calculated?

3) Look at the rate of change is interesting considering that prices are going up even if the "rate of growth has slowed"

1. This guy tracks that stuff.

Alternate Inflation Charts

2. The CPI is designed to minimize inflation, to reduce cost of living payments and the cost of government borrowing. So yeah, the number is a big bag of poo. It’s only when real inflation gets up in the 15% range that it overloads the government’s ability to doctor the CPI.

It’s a bag of poo, but it (and PCE) is still really important for Fed policy, which is 100% of what drives markets these days.

You're statements today have been incorrect. Don't tell me I'm wrong if I am right. Maybe you don't know what you are speaking about?Google gold all time high. You'll get a lot of numbers, all of them higher than $2040.

You're quoting some pre-market futures price, are you saying it's the all time pre-market high?

8:35 am today, gold hit an all time high around 2041.50

You are bringing something up that was changed in the 1980s.1) Does anyone know of a source for the CPI data calculated the way they did before they recently changed it?

2) Comparing the rate of change to a rate of change from last year seems disingenuous on top of changing how it is calculated?

3) Look at the rate of change is interesting considering that prices are going up even if the "rate of growth has slowed"

It doesn't matter what happened 40 years ago, when the cpi measurement is trailing 12 months.

You must always compare apples to apples .

If you find yourself comparing apples to oranges you are in trouble.

The change was to look at "comparables" if the hottest video game system was atari previously. And today it is Xbox, that is a comparable.

If it was the latest flip phone and now it is a flip phone with touch screen, that is a comparable.

It's an entire basket of goods that is being measured. People on the internet who are not educated on the topic, ruin things for others.

The thing that matters is how much change has there been, period.

And yes, things suck right now

Share:

Similar threads

- Replies

- 6

- Views

- 152

- Replies

- 7

- Views

- 111

![Cheers [cheers] [cheers]](/xen/styles/default/xenforo/smilies.vb/018.gif)