-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

-

Be sure to enter the NES/MFS May Giveaway ***Canik METE SFX***

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

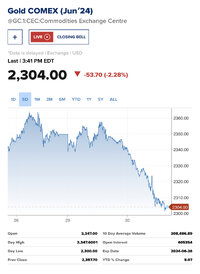

Gold and silver prices are down

- Thread starter Rider

- Start date

Yeah. I'm not feeling like selling anything, though. My timing errors are manifest, but I still like the investments.

Big red candle for GDX to close the month does not bode well for the short term.

No, indeed. Wake me up when it's over.Big red candle for GDX to close the month does not bode well for the short term.

Varmint

NES Member

Big red candle for GDX to close the month does not bode well for the short term.

You don’t want to go up 40% in GDX or $350 gold without a decent pullback. We should retest $2200 at least and bring in some new momentum for the push to $2500.

If you go straight up with no pullbacks you’re too vulnerable to giving it all up again.

mpd61

NES Member

All my silver is in coins, like liberty's, Maples, etc. Should I start buying rounds or something else as well?

Varmint

NES Member

All my silver is in coins, like liberty's, Maples, etc. Should I start buying rounds or something else as well?

I own zero rounds or silver bars. Why not buy some other mint coins like Kruggerands, Perth mint coins etc? Those have lower premiums. I haven't bought any silver since like 2017 but I used to use Ebay to buy from Apmex, MCM and JM Bullion.

$30/oz, that's not great.

Roll of 25 - 2023 South Africa 1-oz Silver Krugerrand BU | eBay

8PC G Britain 2023 King Charles III Definitives Clad BU Set OGP PRESALE. 8PC G Britain 2023 King Charles III Definitives Clad Proof Set OGP PRESALE. 8PC G Britain 2023 King Charles III Definitives Silver Proof Set OGP.

www.ebay.com

Last edited:

For short term traders this is key to set stop losses to avoid a 10% loss of gains or hedge that position to some degree. GDX can easily give back 10%. Why leave those gains on the table? Makes no sense to do so.You don’t want to go up 40% in GDX or $350 gold without a decent pullback. We should retest $2200 at least and bring in some new momentum for the push to $2500.

If you go straight up with no pullbacks you’re too vulnerable to giving it all up again.

It’s strange that gold has not stuck to traditional drivers for it’s rise. Here’s a good thesis to consider which as a chameleon, albeit Tier 1 asset class, gives me pause.

Gold has risen irrespective of:

1. A strengthening USD

2. Positive real rates ala higher bond yields

3. Outflows of gold from etfs

But also due to:

1. Central bank buying

2. Geopolitics

3. Safer havens

HappyHarry

NES Member

All my silver is in coins, like liberty's, Maples, etc. Should I start buying rounds or something else as well?

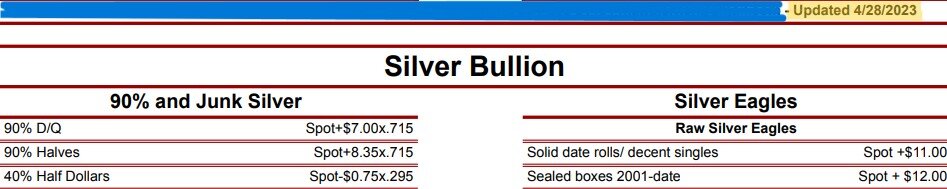

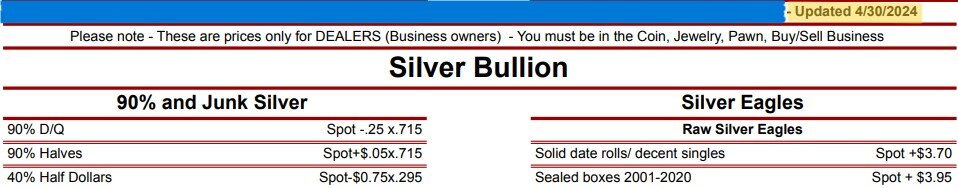

Premiums have pretty much collapsed on silver and gold bullion. U.S. 90% silver half dollars had a premium of $8.35 a year ago, now the premium is $.05 - that's correct 5 cents. Put into perspective, that means if silver is $26/oz, then silver halves would be at 24.56 x face with the $8.35 premium, but only 18.63 x face with the 5 cent premium. Premiums on 1 oz eagles (silver & gold), as well as most other common silver/gold products have seen similar drops.I own zero rounds or silver bars. Why not buy some other mint coins like Kruggerands, Perth mint coins etc? Those have lower premiums. I haven't bought any silver since like 2017 but I used to use Ebay to buy from Apmex, MCM and JM Bullion.

$30/oz, that's not great.

Roll of 25 - 2023 South Africa 1-oz Silver Krugerrand BU | eBay

8PC G Britain 2023 King Charles III Definitives Clad BU Set OGP PRESALE. 8PC G Britain 2023 King Charles III Definitives Clad Proof Set OGP PRESALE. 8PC G Britain 2023 King Charles III Definitives Silver Proof Set OGP.www.ebay.com

These are buy prices from a large, national wholesale-only dealer.

Possibly gold has risen irrespective of the strengthening USD because the strengthening USD is the problem from the point of view of every other nation on the planet.Gold has risen irrespective of:

1. A strengthening USD

2. Positive real rates ala higher bond yields

3. Outflows of gold from etfs

But also due to:

1. Central bank buying

2. Geopolitics

3. Safer havens

Anyway, can't wait to see what kind of stupid crap happens tomorrow. I'm confident that no matter what comes out of the FOMC, what the markets do in reaction will make as much sense as GDX going down when miner revenues are going up.

Varmint

NES Member

Possibly gold has risen irrespective of the strengthening USD because the strengthening USD is the problem from the point of view of every other nation on the planet.

Anyway, can't wait to see what kind of stupid crap happens tomorrow. I'm confident that no matter what comes out of the FOMC, what the markets do in reaction will make as much sense as GDX going down when miner revenues are going up.

Markets are selling off before the Fed, but I think they will surprise to the dovish side tomorrow. That doesn’t make sense given the recent data, but neither did the dovish turn the Fed did this winter, two weeks after saying higher for longer.

Varmint

NES Member

Premiums have pretty much collapsed on silver and gold bullion. U.S. 90% silver half dollars had a premium of $8.35 a year ago, now the premium is $.05 - that's correct 5 cents. Put into perspective, that means if silver is $26/oz, then silver halves would be at 24.56 x face with the $8.35 premium, but only 18.63 x face with the 5 cent premium. Premiums on 1 oz eagles (silver & gold), as well as most other common silver/gold products have seen similar drops.

These are buy prices from a large, national wholesale-only dealer.

View attachment 877410

View attachment 877411

I think this (and continued gold ETF outflows) is evidence that US retail investors are not buying gold and silver, that the rally is coming from central banks and (since the breakout) hedge funds and other institutional investors.

It has no bearing on the price of gold and silver, the US retail PM market is too small to influence the price.

On the whole the data don't make sense. The economy has been in a weird state since the pandemic with supply shocks in goods and labor muddying the waters. Bears have been pointing to an inverted yield curve, and there's simply no way a persistently inverted yield curve is a sign of health. Yet, for a trader, a recession months or years away is something to be worried about when it is imminent, not months and years before it occurs. Even if there is something important about the fundamentals going on there, it becomes practically indistinguishable from a broken clock being right twice a day when the recession ultimately and undeniably arrives.That doesn’t make sense given the recent data, but neither did the dovish turn the Fed did this winter, two weeks after saying higher for longer.

Fed holding rates steady. Balance sheet monthly reduction of $95 billion being brought back to $25 billion monthly. Back to further easing we go! Don’t believe the hype and lies from JPow. They have been performing stealth QE for over a year now. It would be nice for JPow to tell some truths about fiscal incompetence during his presser.

“Under the new plan, the Fed will reduce the monthly cap on Treasurys to $25 billion from $60 billion. That would put the annual reduction in holdings at $300 billion, compared to $720 billion from when the program began in June 2022. The potential mortgage roll-off would be unchanged at $25 billion a month, a level that has only been hit on rare occasions.”

“Under the new plan, the Fed will reduce the monthly cap on Treasurys to $25 billion from $60 billion. That would put the annual reduction in holdings at $300 billion, compared to $720 billion from when the program began in June 2022. The potential mortgage roll-off would be unchanged at $25 billion a month, a level that has only been hit on rare occasions.”

Varmint

NES Member

Fed holding rates steady. Balance sheet monthly reduction of $95 billion being brought back to $25 billion monthly. Back to further easing we go! Don’t believe the hype and lies from JPow. They have been performing stealth QE for over a year now. It would be nice for JPow to tell some truths about fiscal incompetence during his presser.

“Under the new plan, the Fed will reduce the monthly cap on Treasurys to $25 billion from $60 billion. That would put the annual reduction in holdings at $300 billion, compared to $720 billion from when the program began in June 2022. The potential mortgage roll-off would be unchanged at $25 billion a month, a level that has only been hit on rare occasions.”

Interesting day. I was right about the Fed being dovish, and the market had a huge move up, then gave it all back. We’ll see what happens tomorrow, if the market goes up again or continues down. First day of trading after Fed day is often a head fake.

Varmint

NES Member

Silver is back at $27 and gold is $2334.

We’re in a bull market so there’s a chance the correction is over.

We’re in a bull market so there’s a chance the correction is over.

That’s my thought as well. One more Fed meeting with superfluous mumbling “Super core….. data dependent…..hurr durr” and gold will rocket higher as it appears gold is now following Fed speak and sniffing out the lies and deceit.Silver is back at $27 and gold is $2334.

We’re in a bull market so there’s a chance the correction is over.

Varmint

NES Member

That’s my thought as well. One more Fed meeting with superfluous mumbling “Super core….. data dependent…..hurr durr” and gold will rocket higher as it appears gold is now following Fed speak and sniffing out the lies and deceit.

The Fed can say whatever they want, but everyone sees the US debt interest payments now at $1.06 trillion, and in a year it'll be $2 trillion if the Fed doesn't drastically cut rates.

So we all know what they have to do, and soon.

The Fed can buy a little time by stopping QT, but that won't be anywhere near enough.

The market pivoting into stocks doesn't make sense to me, maybe like euphoria over the lifting of stress over what the Fed might have said, but didn't, and now that that's over, I'm feeling good, so out with the safe havens and into the stocks? To treat this as a dip or not to treat this as a dip. That is the question. Problem is that, unlike last time, the metal and mining ETFs don't look cheap on the charts.

Last edited:

Varmint

NES Member

One of my crappy stocks, High Gold Mining just got bought out at a 67% premium. This is a great sign for junior miners, cause 3 months ago stocks were getting taken out at no premium.

While the price still sucks compared to my cost, it’s good because I can sell it and get into another better beaten down miner.

While the price still sucks compared to my cost, it’s good because I can sell it and get into another better beaten down miner.

20 viewers on this thread currently.

So it appears $2300 (futures) is the new floor?

So it appears $2300 (futures) is the new floor?

richc

NES Member

Co-owner of Mattapan plumbing-supply company admits he falsified tax returns so he could buy gold bars | Dorchester Reporter

The co-owner of Economy Plumbing and Heating Supply on Morton Street in Mattapan was charged Tuesday with filing false federal tax returns from the company for several years so he could buy $10 million worth of gold bars and silver ingots, the US Attorney's office in Boston announced yesterday.

Co-owner of Mattapan plumbing-supply company admits he falsified tax returns so he could buy gold bars | Dorchester Reporter

The co-owner of Economy Plumbing and Heating Supply on Morton Street in Mattapan was charged Tuesday with filing false federal tax returns from the company for several years so he could buy $10 million worth of gold bars and silver ingots, the US Attorney's office in Boston announced yesterday.www.dotnews.com

Really a drop in the bucket compared to what bogus democrat organizations have ripped off the American taxpayer for in the past 3 years.

Varmint

NES Member

20 viewers on this thread currently.

So it appears $2300 (futures) is the new floor?

Boston PD?

Varmint

NES Member

Silver is outperforming gold 3:1 overnight, up $.70. $2300 still holding strong for gold.

richc

NES Member

China Is Buying Gold Like There’s No Tomorrow

The global price of gold has reached its highest levels as Chinese investors and consumers, wary of real estate and stocks, buy the metal at a record pace.

Palladin

NES Member

China Is Buying Gold Like There’s No Tomorrow

The global price of gold has reached its highest levels as Chinese investors and consumers, wary of real estate and stocks, buy the metal at a record pace.www.nytimes.com

China is buying gold like there's no tomorrow, jacking up prices - Times of India

China News: Chinese consumers have flocked to gold as their confidence in investments like real estate or stocks has faltered. At the same time, the country's cen

no paywall

Who’s buying physical metals???? I want to but these prices make me pause.

Share:

Similar threads

- Replies

- 6

- Views

- 152

- Replies

- 7

- Views

- 121