AEM

AgnicoEagle just posted record Q1 ‘24 cashflow

“Building on a very strong close to 2023, we are reporting our second consecutive quarter of record operating margins and record free cash flow, on the back of solid operational and cost performance. With this strong start to the year, we are well positioned to achieve our production and cost guidance for 2024," said Ammar Al-Joundi, Agnico Eagle's President and Chief Executive Officer. "During the quarter, we continued to advance our key value drivers and project pipeline, and our exploration program yielded significant results at Hope Bay, Canadian Malartic and Detour Lake. We strengthened our balance sheet in the quarter and our focus remains on capital discipline and cost control, while investing in our projects pipeline and providing returns to shareholders," added Mr. Al-Joundi.”

First quarter 2024 highlights:

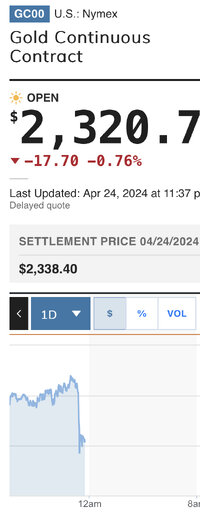

- Strong quarterly gold production – Payable gold production1 in the first quarter of 2024 was 878,652 ounces at production costs per ounce of $892, total cash costs per ounce2 of $901 and all-in sustaining costs ("AISC") per ounce3 of $1,190. Gold production in the first quarter of 2024 was led by record quarterly production at Canadian Malartic and strong production from Macassa and the Company's Nunavut operations

- Record quarterly cash provided by operating activities and free cash flow – The Company reported quarterly net income of $347.2 million or $0.70 per share and adjusted net income4 of $377.5 million or $0.76 per share for the first quarter of 2024. Cash provided by operating activities was $1.57 per share ($1.56 per share before changes in non-cash working capital balances5) and free cash flow5 was $0.79 per share ($0.78 per share before changes in non-cash working capital balances5)

- Strengthening investment grade balance sheet – In the first quarter of 2024, the Company increased its cash position by $186 million and reduced net debt. In addition, in March 2024, Moody's upgraded the Company's long-term issuer rating to Baa1 from Baa2

- 2024 gold production, cost and capital expenditure guidance reiterated – Expected payable gold production remains unchanged at approximately 3.35 to 3.55 million ounces in 2024, with total cash costs per ounce and AISC per ounce in 2024 unchanged at $875 to $925 and $1,200 to $1,250, respectively. Total capital expenditures (excluding capitalized exploration) for 2024 are still estimated to be between $1.6 billion to $1.7 billion