-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax return....

- Thread starter quinnjalan

- Start date

PaulR

NES Member

My office prepares about 275 individual tax returns and we're about 75% through the pile. A rough review of the results show that refunds have been up in 2021 over 2020 and prior years. A lot of that is due to the child tax credit, stimulus and a few other more minor factors. For fairly straightforward returns with 2 W-2 incomes being the primary income source, significant underpayments have generally been due to either a withholding error or bonuses/stock options being a wrench in the works.

And it used to be fairly easy to guesstimate the W-4 withholdings based on a quick review of a tax return, but no more. Believe it or not, the IRS withholding estimator is now the best way to dial in to your refund number. At the same time, everything has to be in sync on your return with no surprises for this to be effective. Unfortunately, there hasn't been a consistent year for most people in a while.

So you don't focus much on tax clients? Or do high net worth. We take on all comers, each of us do over 400 returns, and there are 5 of us. I'm over 200 myself now, I will be close to 400 on 4/15. I'm totally fawked this year, lost help, I'll be pulling a few all-nighters. I've been doing great mentally and physically so far, but if don't have a heart-attack by 4/15 it will be a miracle.

TrackDayRdr

NES Member

So you don't focus much on tax clients? Or do high net worth. We take on all comers, each of us do over 400 returns, and there are 5 of us. I'm over 200 myself now, I will be close to 400 on 4/15. I'm totally fawked this year, lost help, I'll be pulling a few all-nighters. I've been doing great mentally and physically so far, but if don't have a heart-attack by 4/15 it will be a miracle.

We're a tax and consulting office.

I don't care to disclose the composition of my client list here, but will give you guys kudos for doing over 400 each. If I pick up 10 projects a day, about 8 require email lists of missing items, clarification, etc. We lost help too and I'm doing triple duty which I didn't think I would ever need to do 20 years in. Crazy. Finding people who want to work is hard, finding people who can do what they say they can do is harder. There is no such thing as "attention to detail" any more.

Asaltweapon

NES Member

Filed by paper, the same way I always do. IRS cashed the payment in under 2 weeks.

And now we (married filing jointly both work, no kids) somehow owe over $6,000. I don't understand wtf is going on. Owed $1400 in 2020 and owe over $6,000 for 2021. Aside from annual raises nothing else changed. Annoying as f***.Wife and I owed just over $1400.

No kids.

She’s pissed she’s getting no money back for the first time in many years. I told her I’m fine owing $1400 which will be spit 50/50 between us. As you said, close enough.

A lot better than 2019. I owed almost 5k because of a new job I started and F’d up the withholdings etc. Wife got 5k back (was a student) and gave it to me to pay it off. Made the necessary changes for 2020.

We only use turbotax but I told my wife we should probably pay a tax person for 2022 taxes just to see if TT is wrong?

I wondered if I should fill out line 4C on the W4 Extra Withholding to get more taxes taken out (assuming TT is correct...). A quick google search says you divide what you owe IRS ($6,000) by the number of pay periods left in the year? My wife claims when she ran through TT filing separately/single by herself she owed like $1200. So I'm the one owing like $5,000ish....

If that's true, I got 19 paychecks left this year. $5,000 / 19 = $263 as Extra Withholding

- Joined

- Sep 10, 2009

- Messages

- 41,857

- Likes

- 79,509

And now we (married filing jointly both work, no kids) somehow owe over $6,000. I don't understand wtf is going on. Owed $1400 in 2020 and owe over $6,000 for 2021. Aside from annual raises nothing else changed. Annoying as f***.

We only use turbotax but I told my wife we should probably pay a tax person for 2022 taxes just to see if TT is wrong?

I wondered if I should fill out line 4C on the W4 Extra Withholding to get more taxes taken out (assuming TT is correct...). A quick google search says you divide what you owe IRS ($6,000) by the number of pay periods left in the year? My wife claims when she ran through TT filing separately/single by herself she owed like $1200. So I'm the one owing like $5,000ish....

If that's true, I got 19 paychecks left this year. $5,000 / 19 = $263 as Extra Withholding

- Joined

- Apr 17, 2016

- Messages

- 1,685

- Likes

- 1,535

I know someone in the department who got promoted, and HR goofed up their withholdings. They didn't pay Federal or something goofy. Ended up owing $5k last year...And now we (married filing jointly both work, no kids) somehow owe over $6,000. I don't understand wtf is going on. Owed $1400 in 2020 and owe over $6,000 for 2021. Aside from annual raises nothing else changed. Annoying as f***.

We only use turbotax but I told my wife we should probably pay a tax person for 2022 taxes just to see if TT is wrong?

I wondered if I should fill out line 4C on the W4 Extra Withholding to get more taxes taken out (assuming TT is correct...). A quick google search says you divide what you owe IRS ($6,000) by the number of pay periods left in the year? My wife claims when she ran through TT filing separately/single by herself she owed like $1200. So I'm the one owing like $5,000ish....

If that's true, I got 19 paychecks left this year. $5,000 / 19 = $263 as Extra Withholding

Unless you guys made like $20k more YOY?

If so. Is your Department hiring? Kidding, but not really...

Ohh shit. I don’t think mine is messed up? My W2 says I had I paid several thousands in Fed and state withholdingsI know someone in the department who got promoted, and HR goofed up their withholdings. They didn't pay Federal or something goofy. Ended up owing $5k last year...

Unless you guys made like $20k more YOY?

If so. Is your Department hiring? Kidding, but not really...

My wife did win $17k last spring on the radio (Kiss 108). She was getting a $1000 refund until she entered the 1099 info for the winnings. That made her owe $1700 for 2021 - this was all done through TT filing separately/single just to see what she’d get. Then once she did jointly, it went up to $7000 (I previously said $6000 but I was off) total for Fed ($6k) and MA ($1k).

She’s saying it’s because of me that we owe $7k so she’s saying I need to pay the $5000ish and she pays the $2000ish.

I think we could really benefit from seeing a CPA

I guess it’s good I got a $1k Covid bonus in my last paycheck….

And over the next couple months I’ll get retro pay now that our union finally has a contract with the state. I heard a 1.5% signing bonus plus retro pay going back to July 2020…that ought to cover my owed taxes.

Took forever and now the new contract expires in July of this year

So back to more delays on getting contract raises….

And over the next couple months I’ll get retro pay now that our union finally has a contract with the state. I heard a 1.5% signing bonus plus retro pay going back to July 2020…that ought to cover my owed taxes.

Took forever and now the new contract expires in July of this year

So back to more delays on getting contract raises….

cathouse01

NES Member

- Joined

- May 10, 2018

- Messages

- 2,441

- Likes

- 4,668

I would see a CPA right now. You can still file an amended return. If you're saying that adding in the 17K prize upped your taxes by $6K Fed and $1K MA, something is off. The 5% MA income tax on $17K should be $850 and to get to $6000 on the federal you’d have to be in the 35% marginal tax bracket (the second highest) which means you and your wife should have an adjusted gross income of $418,851 to $628,300. And if that’s the case, stop pissing about a mere $7KOhh shit. I don’t think mine is messed up? My W2 says I had I paid several thousands in Fed and state withholdings

My wife did win $17k last spring on the radio (Kiss 108). She was getting a $1000 refund until she entered the 1099 info for the winnings. That made her owe $1700 for 2021 - this was all done through TT filing separately/single just to see what she’d get. Then once she did jointly, it went up to $7000 (I previously said $6000 but I was off) total for Fed ($6k) and MA ($1k).

She’s saying it’s because of me that we owe $7k so she’s saying I need to pay the $5000ish and she pays the $2000ish.

I think we could really benefit from seeing a CPA

- Joined

- Apr 17, 2016

- Messages

- 1,685

- Likes

- 1,535

-I'd check your W4 withholding status. HR is a joke. Also your wifes W4.Ohh shit. I don’t think mine is messed up? My W2 says I had I paid several thousands in Fed and state withholdings

My wife did win $17k last spring on the radio (Kiss 108). She was getting a $1000 refund until she entered the 1099 info for the winnings. That made her owe $1700 for 2021 - this was all done through TT filing separately/single just to see what she’d get. Then once she did jointly, it went up to $7000 (I previously said $6000 but I was off) total for Fed ($6k) and MA ($1k).

She’s saying it’s because of me that we owe $7k so she’s saying I need to pay the $5000ish and she pays the $2000ish.

I think we could really benefit from seeing a CPA

- Joined

- Apr 17, 2016

- Messages

- 1,685

- Likes

- 1,535

Haha working for .gov is full ofI guess it’s good I got a $1k Covid bonus in my last paycheck….

And over the next couple months I’ll get retro pay now that our union finally has a contract with the state. I heard a 1.5% signing bonus plus retro pay going back to July 2020…that ought to cover my owed taxes.

Took forever and now the new contract expires in July of this year

So back to more delays on getting contract raises….

Mark from MA

NES Member

- Joined

- Jun 4, 2008

- Messages

- 11,635

- Likes

- 11,844

1K out to the feds....I mean...illegal aliens. Next year will be worse.....with no college. I say that but I wont be writing checks either. Wife and I also got way bigger bonuses this year.

Upped the 401K to 20%......10% of it going straight to the safe fund, as I'm nearing retiring. Better me than them even if I can't touch it for a while.

Upped the 401K to 20%......10% of it going straight to the safe fund, as I'm nearing retiring. Better me than them even if I can't touch it for a while.

VetteGirlMA

NES Member

1K out to the feds....I mean...illegal aliens. Next year will be worse.....with no college. I say that but I wont be writing checks either. Wife and I also got way bigger bonuses this year.

Upped the 401K to 20%......10% of it going straight to the safe fund, as I'm nearing retiring. Better me than them even if I can't touch it for a while.

How do you get past the 401k cap? I've been thinking off loading more income to a roth ira since I've paid taxes on it and I end up hitting the 401k cap. My bonus is usually pretty good although this year I also received a pretty decent pay raise amid the inflation. I was pretty much ahead of inflation but the raise keeps me ahead of it. Then again my company bled out a lot of people last year in key management positions so we're running really short staffed in IT. Good for me, but dayum I'm going nuts right now while we try to hire and/or promote new folks. Interesting that in 2022, some people are turning down promotions.

I would see a CPA right now. You can still file an amended return. If you're saying that adding in the 17K prize upped your taxes by $6K Fed and $1K MA, something is off. The 5% MA income tax on $17K should be $850 and to get to $6000 on the federal you’d have to be in the 35% marginal tax bracket (the second highest) which means you and your wife should have an adjusted gross income of $418,851 to $628,300. And if that’s the case, stop pissing about a mere $7K.

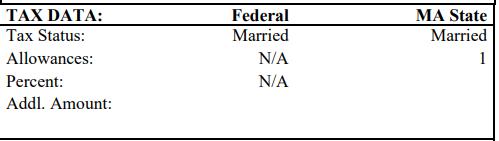

This is what it says on my paycheck-I'd check your W4 withholding status. HR is a joke. Also your wifes W4.

Makes no sense. I looked at last years W2 and it was $600 less withheld for fed and $300 less for state. Why the f*** I owe so much more this year is beyond me. Allowances haven't changed.

I made a few thousand more than the previous year.

And no my wife and I's combined income is only a fraction of $418,851

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Amputee Marksman

NES Member

Owed State $32 and Feds $5800. M

If you are over 50 you can contribute "catch up" money. For 2022 the limit for catch up dollars is $6500

How do you get past the 401k cap?

If you are over 50 you can contribute "catch up" money. For 2022 the limit for catch up dollars is $6500

She’s going to go through TT filing separately for her and then for me and see what the difference isThis is what it says on my paycheck

View attachment 605490

Makes no sense. I looked at last years W2 and it was $600 less withheld for fed and $300 less for state. Why the f*** I owe so much more this year is beyond me. Allowances haven't changed.

I made a few thousand more than the previous year.

And no my wife and I's combined income is only a fraction of $418,851![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

bfm

NES Member

LOL, same. Despite making quarterly payment, taking no deductions and having an extra $250 taken out of ever paycheck, I owe just slightly less than I paid for the new Audi I bought in 2001. Not enough to buy an Audi now, but enough to pay for a new midrange Honda.ugh...I could buy a nice car with the checks going out today.

namedpipes

NES Member

Willing to bet they cashed the checks they received WHEN they received them, though.Got a call from the guy from our senator’s office assigned to our case. Turns out the IRS is just now about to start opening mailed returns from last April. Unreal.

Amputee Marksman

NES Member

I owed the Feds almost $6k this year. When I did my taxes I did them completely only adding my W-2, not my wives, and I was almost dead nut even. I then went back and added her W-2 and bam we owed all this money. I claim married 1 and she claims married 0. The only reason I can think of is that I make approximately 2.5x what she makes so they are withholding her taxes at a much lower rate. It used to be that her claiming married 0 was enough to get us pretty close. I looked at we owed, did a little quick math and then filed a new W-4 with additional taxes for Feds.

namedpipes

NES Member

...

She does the taxes, and then I proofread them.

Only 2-3 times in over 35 years have I brought any value whatsoever to the table

beyond finding trivial typos or missing chickensh¡t deductions.

...

I hand a pile of papers and receipts to my accountant. A few weeks later he gives me a stack of papers an inch or two thick and points to where I sign. Sometimes I have to write a check for $10k-$20k and sometimes something is coming back.

Last time I actually LOOKED at a return I had a literal heart attack so now I just sign whatever he puts in front of me. So far neither of us has landed in jail. Well, in the US anyway.

My wife and I owed $6,200 on our 2019 taxes, so we played around with out withholdings. That number went down to $2,800 owed for our 2020 taxes. So we played around again with 401K contributions and withholdings. For 2021 we are due a refund of $3,700.

The IRS does pay interest on DELAYED refunds if I recallWilling to bet they cashed the checks they received WHEN they received them, though.

namedpipes

NES Member

Not going to look through 12 pages to see if I related this story here, but back in the 90s I had a buddy that was a race car driver. He needed to give his mechanic some money and decided to pay it in ones. We went to his bank and took out a grand in the form of a shrink wrapped brick of ones. (you have to call ahead a day or two in advance, turns out). We get to the shop and there's a long line of people making similar deposits. (thinking back, this seems odd. I wonder if the mech was really his bookie?)

Anyway, we get to the table and he hands over the brick, the mech looks exasperated and tosses it onto the table, makes a ledger entry and we turn to leave.

The NEXT guy in line picks up the bundle, examines it, turns to study us, we notice his baseball cap reads IRS, we quickly depart.

The only other related story involves strippers and is not suitable for this forum.

Anyway, we get to the table and he hands over the brick, the mech looks exasperated and tosses it onto the table, makes a ledger entry and we turn to leave.

The NEXT guy in line picks up the bundle, examines it, turns to study us, we notice his baseball cap reads IRS, we quickly depart.

The only other related story involves strippers and is not suitable for this forum.

Share:

Similar threads

- Replies

- 6

- Views

- 183

- Replies

- 13

- Views

- 563