Varmint

NES Member

I retired at 49 with no mortgage, no car payments, no debt of any kind. If you have a better system, go for it.

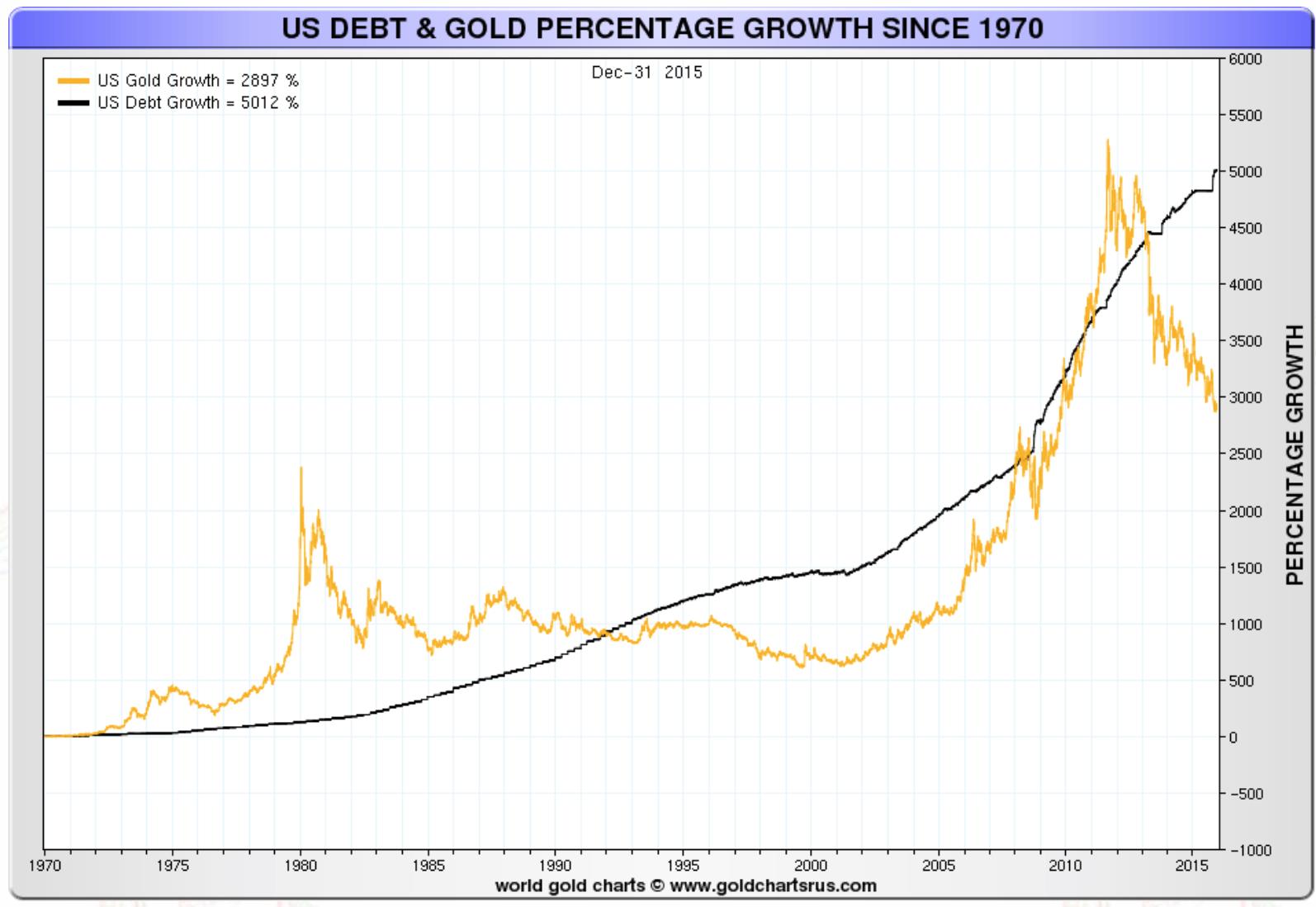

Debt is a tool, it can be used well and misused. You can do really well borrowing money to buy say, a rental home and generate cash flow, as well as own an appreciating asset. With a dollar that's losing 4-5% value every year, it makes no sense to pay off a 3% mortgage with today's dollars instead of future ones. If it makes you feel better, do it, but I wouldn't tell other people to do it.