-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If you had to leave Mass and move north...

- Thread starter TFLeader

- Start date

JFC! That would pay my mortgage for 10 months, or my property tax on my 4.2 acre residence for just under 20 yrs!!We just bought a place in NH. Property taxes are $10k a year.

NHCraigT

NES Member

Moved from MA to NH in jan 89.

.... Have never looked back.

In 2008, we made the move a little bit further away (still in nh).... but further away from the gangrene infested southern NH border ;-)

.... Have never looked back.

In 2008, we made the move a little bit further away (still in nh).... but further away from the gangrene infested southern NH border ;-)

Last edited:

it really depends on what you like to do for activities, etc.

It depends what school district you are in.

Concord and surrounding towns pretty high.

Some towns crazy low. For retirees who want space, staying 20 miles outside of major highway corridors is good guidance for reasonable price and tax rates.

We’re going to be paying a premium on our place.....

We just picked up a spot in NH. Love it. 10 to 1 trump vs dementia joe signs. I Found a local barbershop and thought I’d give it a whirl, went in to get a cut walked out with a 20 gauge shotgun. Barber Had a couple guns sitting on a chair with a for sale sign along with some other hunting gear. That was week one of owning the place. Last one gets out of school and Mass Can kiss my rebel dick, I’m out.

Asaltweapon

NES Member

But it’s not forever. I’m not saying it can be bad mind you. My buddy and I got out of the truck to fly fish West Outlet and we didn’t even get our shoes off for our waders before we bagged that so we went and had a few beers.Not for nothing, but the black fly season is just about to kick off in Maine...

If you have not experienced the joys of the season - you really owe it to yourself to travel up there and spend some time outdoors

Always have a back up plan.

- Joined

- Jan 25, 2008

- Messages

- 7,343

- Likes

- 12,568

You think the US is still going to exist as we know it in 5-10 years? That's cute.

THIS

- Joined

- Jan 25, 2008

- Messages

- 7,343

- Likes

- 12,568

Maine is doing it for me.

Despite my love for NH, for me I think Maine is a better option for relocating if you are looking to retire (and want to be in the woods like me). In NH the White Mountain regional can get too frigging busy at certain times of the year and anything south of the White Mountains is too developed for me and it is only going to get worse at a rapid pace.

namedpipes

NES Member

I would look to move out of New England completely. There are better states in the middle of the country. You don't want to move up here then have to move again in 10 years.

That's precisely what my plan is. My work requires proximity to Bawston. After I retire I can go where I please. Probably winter in Florida and spent 3 seasons at the compound in Montana. Waffling on traveling between the two by RV or just taking the Lear

That's high, but no state income tax. We pay ~$11K per year in property tax plus the MA state income tax. If I were to leave MA and stay in New England, definitely would go to NH.

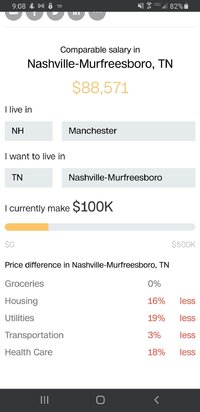

For anyone considering TN, property taxes will be somewhere near 1/3 or less than what they are for the same value in MA depending upon how 'nice' your assessment is. One year our new TN assessment came back high. I called the tax office and got the county assessor. Told him I'd be thrilled to sell my house at their value. He laughed and said let's pull it up in the system, then agreed that the jump was excessive. Right over the phone we agreed on a reasonable assessed value- it was that easy.

Yup. Our place in NC went from $330k assessed value to approx $400k at the last go round. Made one phone call and once the guy realized I had some legitimate gripes they did a real reassessment rather than just basing it on the fact that a farm down the road just sold for $1M and a place over the ridge just sold for $600k. Came down to $265k. Needless to say, I was pretty happy about that.

If you grew up in New England and actually like the climate, enjoy winter sports, have family nearby that you want to be able to see easily, etc. Going south is all well and good if that's your thing but keep in mind that you'll always be the Yankee and it's a different culture. I'm not saying it's better or worse, just different. Moving from MA to NH or ME requires no cultural shift. Half the people up here are from MA originally.

Your kids, and their kids, will always be Yankees too.

RJDN 04

NES Member

Yeah CACR8 failed to get the 3/5 vote to be moved to citizens for final say. But, SB154 has a very good chance of making it thru which prevents presidental executive orders from impeading 2A rights under NH Constitution.isn't NH trying to enact legislation to counter any federal 2A bans? because of that I would choose NH.

Something to consider in the TN vs. NH discussion: OK, NH property tax is significantly higher, but no sales tax in NH vs. sales tax as high as ~10% in some TN cities.

I see where your goin, but you have to look at it on a much larger scale. I'll use what I'm doin as an example.

In Honkytown, Mass, or what the locals call West Bridgewater, my property taxes were at $5200 and going up. On a half acre.

In Rural Honkytown, or what the locals down there call Walden/ Signal Mountain Tenn, my property taxes on 8 empty acres is $325 a year.

Current build price, including the acrerage that we just paid off is about $620,000.

Estimated property tax on property in Rural Honkytown is about $1300 a year. About 3--40 mins outside Chattanooga.

Now lets look at sales tax vs prop tax. Full disclosure- I have a few dents in my head and have a skewed outlook on things.

I'll use $10,000 as a number, because it gets thrown around so much. I'm assuming that # comes from the more populated areas in and around the bigger n.h. towns/ cities-

So we have 10 vs 52 vs 13..

Fked in Mass. Sales tax of 6.25 (?) and Income taxes and fees on everything else, so theres that. Lets say $6 billion , because thats what it feels like.

Tenn has low prop tax, but sales tax can be 8/9/10% depending on the county and the item.

NH has no sales tax, but high prop tax depending on the area.

Lets use 10% sales tax as a number.

I would have to spend about $85,000 a year, for the Tenn sales Tax of 10% (plus prop tax) to equal that 10 grand n.h. property tax.

Know what I mean?

Plus. I got 8 acres. Enough privacy that I can stroll around the backyard in my goddam speedos waving my murican flag and nobodies going to see it! Or Broc can rent out the back 40 and have his Super Gay 9mm Dance Party.

If I tried that here, or in the Northeast in the burbs or near some city, the Staties would show up, AGAIN. And the news would show up, AGAIN. And my taxes would go up, AGAIN.

ChevyGuy91

NES Member

- Joined

- Mar 25, 2008

- Messages

- 22,923

- Likes

- 23,513

$5200 for a half acre in W Bridgewater? I'm going to LOL at the next person that complains about NH property taxes.I see where your goin, but you have to look at it on a much larger scale. I'll use what I'm doin as an example.

In Honkytown, Mass, or what the locals call West Bridgewater, my property taxes were at $5200 and going up. On a half acre.

In Rural Honkytown, or what the locals down there call Walden/ Signal Mountain Tenn, my property taxes on 8 empty acres is $325 a year.

Current build price, including the acrerage that we just paid off is about $620,000.

Estimated property tax on property in Rural Honkytown is about $1300 a year. About 3--40 mins outside Chattanooga.

Now lets look at sales tax vs prop tax. Full disclosure- I have a few dents in my head and have a skewed outlook on things.

I'll use $10,000 as a number, because it gets thrown around so much. I'm assuming that # comes from the more populated areas in and around the bigger n.h. towns/ cities-

So we have 10 vs 52 vs 13..

Fked in Mass. Sales tax of 6.25 (?) and Income taxes and fees on everything else, so theres that. Lets say $6 billion , because thats what it feels like.

Tenn has low prop tax, but sales tax can be 8/9/10% depending on the county and the item.

NH has no sales tax, but high prop tax depending on the area.

Lets use 10% sales tax as a number.

I would have to spend about $85,000 a year, for the Tenn sales Tax of 10% (plus prop tax) to equal that 10 grand n.h. property tax.

Know what I mean?

Plus. I got 8 acres. Enough privacy that I can stroll around the backyard in my goddam speedos waving my murican flag and nobodies going to see it! Or Broc can rent out the back 40 and have his Super Gay 9mm Dance Party.

If I tried that here, or in the Northeast in the burbs or near some city, the Staties would show up, AGAIN. And the news would show up, AGAIN. And my taxes would go up, AGAIN.

$5200 for a half acre in W Bridgewater? I'm going to LOL at the next person that complains about NH property taxes.

And it was going up.

Which is why I sold it.

ChevyGuy91

NES Member

- Joined

- Mar 25, 2008

- Messages

- 22,923

- Likes

- 23,513

That is getting real close to what I pay up here for 1700 sqft, 2 car garage, and 6+ acres ~45 mins from Portsmouth/Manch/Concord.And it was going up.

Which is why I sold it.

That is getting real close to what I pay up here for 1700 sqft, 2 car garage, and 6+ acres ~45 mins from Portsmouth/Manch/Concord.

It was getting retarded, and its only going to go up. 2000 sq ft and 2 car garage.

It also sold for retarded money. Some potato from Roxbury or Jamaica Plain bought it.

Good luck to em.

Join me in the rural life of Tennessee.............we'll make moonshine together.......

greencobra

NES Member

- Joined

- Jul 2, 2011

- Messages

- 27,215

- Likes

- 26,704

in as soon as 10 years new hampshire will have turned fully blue. enjoy the short time you have left.

- Joined

- Apr 23, 2011

- Messages

- 1,291

- Likes

- 1,288

The sad thing about all this is it may be irrelevant with the current political administration bankrupting the country and allowing us to be over run by illegals. Never mind being in bed with the Chicoms and a general weakness towards our enemies.

What state would you choose: Maine or New Hampshire? From a firearms point of view. Taxes, chances of future legislation, etc.

I wouldn't......I'd turn around and head south for a warmer climate, less expensive housing, lower taxes, lower cost of living in general.

One thing that hasn't been mentioned is the people. While I can't speak for Maine , I Have been VERY impressed with th NH people.\

I had one time I got my truck stuck in a ditch.

Two vehicles pulled over and helped me get it out . I tried giving the two guy $20 each but they wo9uldn't take it' .

And I wasn't car jacked.

ggboy

I had one time I got my truck stuck in a ditch.

Two vehicles pulled over and helped me get it out . I tried giving the two guy $20 each but they wo9uldn't take it' .

And I wasn't car jacked.

ggboy

Randy Lahey

NES Member

Not Maine with Janet Mills... NH might be better. Vermont is right out sadly.What state would you choose: Maine or New Hampshire? From a firearms point of view. Taxes, chances of future legislation, etc.

Share:

Similar threads

- Replies

- 19

- Views

- 567

- Replies

- 17

- Views

- 618

- Replies

- 1

- Views

- 84