We could pull back to the $1600’s but that area is a hard stop of resistance. I agree that this is another consolidation of the recent run up in gold and gold equities. The dollar is on a down turn but it will recover and shoot higher if we get further market pain. I do believe this is simply another bear market rally and earnings is gonna be super sour in Q1. They are hiding the poor earnings this quarter with ease but it will get much worse with embedded inflation and if this disinflation cycle we just moved into from stagflation turns into deflation (which I don’t believe central banks will tolerate) then we will go right back to QE or some transmutation of it.

-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold and silver prices are down

- Thread starter Rider

- Start date

76Too

NES Member

I was thinking a little more like 1929.I think this one is going to be more like 2008 than 2020.

Edit: But the whole point is that with other things happening at the same time, the price of Gold might go up, anyway.

Could be. All I can tell you is that I think it's going to be ugly. @DJBrad is correct that earnings are going to be sour, and I don't think they will be able to stop the drop. I don't have the acumen to time things or to recognize and respond on a dime just before it happens, so I used the latest rally to pull out of stocks (mostly). We'll see how it goes. I'm not young enough that I want to take on a lot of risk, but I think I'll be able to seize some buying opportunities after the conflagration is mostly over. I won't be able to time that, either, though.I was thinking a little more like 1929.

76Too

NES Member

I’m 40 and I basically just started saving for retirement 4 years ago and have less than 100k ‘all in’, so I don’t think it really matters all that much what I do yet.Could be. All I can tell you is that I think it's going to be ugly. @DJBrad is correct that earnings are going to be sour, and I don't think they will be able to stop the drop. I don't have the acumen to time things or to recognize and respond on a dime just before it happens, so I used the latest rally to pull out of stocks (mostly). We'll see how it goes. I'm not young enough that I want to take on a lot of risk, but I think I'll be able to seize some buying opportunities after the conflagration is mostly over. I won't be able to time that, either, though.

If gold goes to $1400/oz, I’m holding what I bought (face to face and tax free) at $2000/oz…if it goes to $4000/oz, I’m holding what I bought at $2000/oz.

If I need to buy something I need if I don’t have anything else and cash is worthless, I’ll use gold (or silver)…until then, I’m staying put.

Varmint

NES Member

I think this one is going to be more like 2008 than 2020.

Edit: But the whole point is that with other things happening at the same time, the price of Gold might go up, anyway.

Yes I think the same. Probably worse than 2008, and I think gold will go up big starting next year when the Fed has to pivot and restart QE.

Varmint

NES Member

I was thinking a little more like 1929.

There’s so much debt in the system I don’t see how this can go on for years. But it’s already gone on years past its sell by date so maybe.

Varmint

NES Member

Could be. All I can tell you is that I think it's going to be ugly. @DJBrad is correct that earnings are going to be sour, and I don't think they will be able to stop the drop. I don't have the acumen to time things or to recognize and respond on a dime just before it happens, so I used the latest rally to pull out of stocks (mostly). We'll see how it goes. I'm not young enough that I want to take on a lot of risk, but I think I'll be able to seize some buying opportunities after the conflagration is mostly over. I won't be able to time that, either, though.

It is tough to invest when the Fed is constantly meddling in the markets. It’s like trying to count cards when the dealer is cheating.

Congress, too. I'm sure they're thinking what we really need right now is one more huge spending bill. One more for the road for the 117th Congress.It is tough to invest when the Fed is constantly meddling in the markets. It’s like trying to count cards when the dealer is cheating.

Varmint

NES Member

Congress, too. I'm sure they're thinking what we really need right now is one more huge spending bill. One more for the road for the 117th Congress.

They probably have trillions in spending all lined up, just waiting for some economic or financial bonfire that'll get Republicans onboard.

Win

NES Member

The more I look at the history of money, the silver content diminishing from coins, gold coins going extinct altogether, the advent of digital token, NFTs, etc I believe that there is a concerted effort to confuse the populace as to what money and value are. It's been a hugely successful effort. Very few people actually own any money with the younger generations bamboozled into thinking that virtual items with no physical manifestation in the world are the best money of all!

When I look at modern coins made from cheap metals, I wonder why they exist at all? What is even the point of a modern quarter? It'd be easier to carry and have the same intrinsic value as a small note. From where I sit, it appears to be a deception.

When I look at modern coins made from cheap metals, I wonder why they exist at all? What is even the point of a modern quarter? It'd be easier to carry and have the same intrinsic value as a small note. From where I sit, it appears to be a deception.

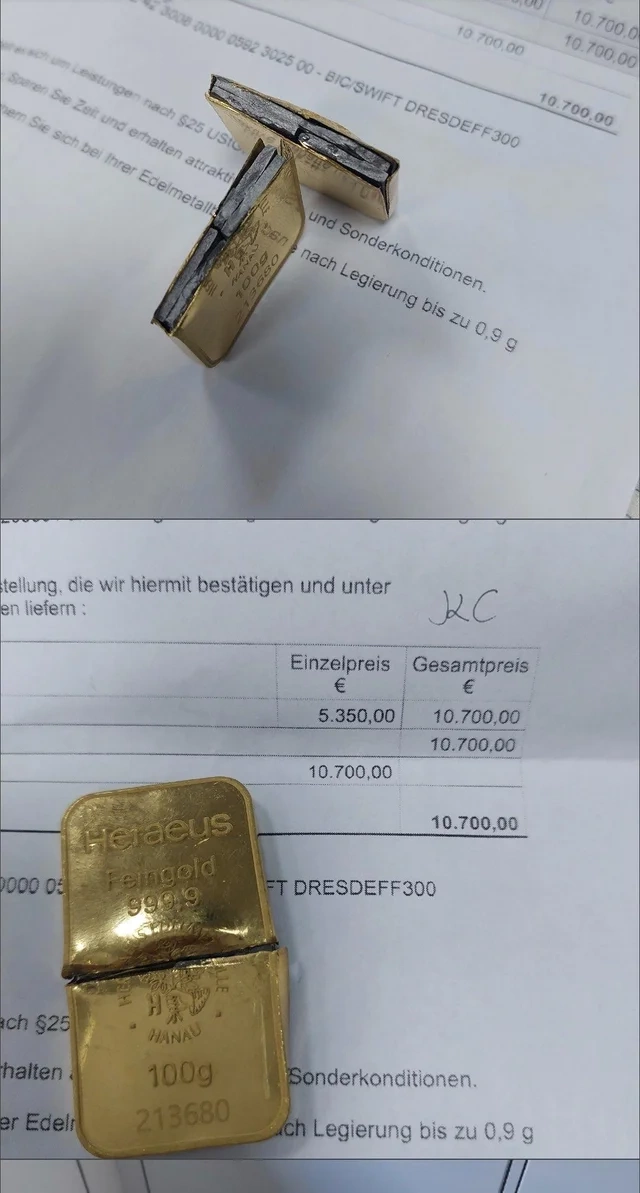

Scottsdale Mint on Gab: 'This is the reason you always buy from trusted de…'

Scottsdale Mint on Gab: 'This is the reason you always buy from trusted dealers. Trying to save a few bucks buying from sketchy 3rd parties can be a devastating loss. You need to know their address. Our amazing customers report fraudulent sellers to us all the time, China has ramped up...

smokey-seven

NES Member

Coin lasts longer than notes and in the long run is cheaper to produce.What is even the point of a modern quarter? It'd be easier to carry and have the same intrinsic value as a small note.

The only point of coin change is that inflation has not reached the point where all prices are rounded up to the next dollar.

When I get into discussions about our coinage, I carry a small leather pouch with $5 face in silver coin and a few silver eagles. They are always surprised to learn that we actually had silver coin as regular money.

smokey-seven

NES Member

Read this one today. As an aside, I have read that each solar panel has 1.5 Oz of silver in it and it is too inefficient and expensive to recover when the panel needs replacement. I ponder the numbers....

menafn.com

menafn.com

World is about to run out of silver

The Silver Institute, a United States-based organization that monitors the metal, stated in its most recent report that the world is on the verge of

Win

NES Member

I think the silver shortage is bound to happen but I've heard varying timelines - between "later this year" and 15 years. There's likely some gradient of diminishing supply in there.

Varmint

NES Member

Read this one today. As an aside, I have read that each solar panel has 1.5 Oz of silver in it and it is too inefficient and expensive to recover when the panel needs replacement. I ponder the numbers....

World is about to run out of silver

The Silver Institute, a United States-based organization that monitors the metal, stated in its most recent report that the world is on the verge ofmenafn.com

Run away from any article saying we’re about to run out of silver/gold/oil etc.

At $25 silver, a lot more deposits become economical, and at $30 again a lot more become economical.

smokey-seven

NES Member

So how many more million oz of silver will be produced at $30 an oz?At $25 silver, a lot more deposits become economical, and at $30 again a lot more become economical.

76Too

NES Member

Stupid question, but I actually thought we could MAKE silver (but not gold.)

I think we made it in a chemistry class once. It’s not exactly the kind you would make into jewelry or coins, but suitable for industrial applications.

I think we made it in a chemistry class once. It’s not exactly the kind you would make into jewelry or coins, but suitable for industrial applications.

Varmint

NES Member

Stupid question, but I actually thought we could MAKE silver (but not gold.)

I think we made it in a chemistry class once. It’s not exactly the kind you would make into jewelry or coins, but suitable for industrial applications.

You're probably thinking of diamonds.

Varmint

NES Member

So how many more million oz of silver will be produced at $30 an oz?

Dunno, but my point was that there is tons of silver in the ground, but much of it would cost too much at $20 silver to be worth mining. But at $30, all of a sudden those deposits become economical, and the mines would get built, supplying more silver to the market.

And the crappy junior mining stock that owns that deposit will go up 1000%.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Win

NES Member

God made precious metals. Man makes fiat currency, digital tokens and NFTs.

76Too

NES Member

You're probably thinking of diamonds.

The process I was thinking of is ‘extracted’ from silver nitrate.

Are you hunting werewolves in KY with nvg seeboJKs now?The process I was thinking of is ‘extracted’ from silver nitrate.

Here’s my prediction, whatever I think the price of gold and silver will be, short my prediction! Gold $1,900 and Silver $25 by Feb 2023. You’re all welcome!

smokey-seven

NES Member

Way back when silver was 2x the price it is now, I had a friend that collected Xray photo's Silver nitrate and processed them for scrap silver. He did well but the price of silver was rising to $40.00 an ounce.The process I was thinking of is ‘extracted’ from silver nitrate.

richc

NES Member

Decent deal. And IMHO the obverse of the coin looks a bit like Trump in drag...

20 Francs Swiss Helvetia Vreneli Gold Coin AGW .1867 oz AU/BU (1897-1949, Random | eBay

TheSwiss 20 Francs Vreneli gold coins were produced from 1897 to 1936 when production ceased due to the onset of the Great Depression. However, restrikes of this coin were later issued in 1947 and 1949.

www.ebay.com

76Too

NES Member

Decent deal. And IMHO the obverse of the coin looks a bit like Trump in drag...

20 Francs Swiss Helvetia Vreneli Gold Coin AGW .1867 oz AU/BU (1897-1949, Random | eBay

TheSwiss 20 Francs Vreneli gold coins were produced from 1897 to 1936 when production ceased due to the onset of the Great Depression. However, restrikes of this coin were later issued in 1947 and 1949.www.ebay.com

I’ll never be able to ‘unsee’ that now, thank you.

richc

NES Member

Win

NES Member

I went to the Devens Mass coin show this past weekend and sold several numismatic silver coins and a couple of generic world gold coins that were no longer "singing" to me. I was hoping to get a little over spot gold but I sold them for several hundred dollars over spot. Today, those checks cleared, and I paid off my truck. I'll be buying back into world gold coins over the next several months.

Anyway, to Rich's point, I think demand is high. What I'm not certain of is if the market is going to really crash dragging PMs back down further. It's possible. I made a defensive play by selling some coins, paying off my truck, and limiting my liabilities. I have a low risk tolerance.

Anyway, to Rich's point, I think demand is high. What I'm not certain of is if the market is going to really crash dragging PMs back down further. It's possible. I made a defensive play by selling some coins, paying off my truck, and limiting my liabilities. I have a low risk tolerance.

bigbravehog

NES Member

- Joined

- Jun 2, 2013

- Messages

- 6,425

- Likes

- 16,721

I planned on going to the show but bailed out. I have gone to EJW shows in Worcester for many years but the last few times have been disappointed.I went to the Devens Mass coin show this past weekend and sold several numismatic silver coins and a couple of generic world gold coins that were no longer "singing" to me. I was hoping to get a little over spot gold but I sold them for several hundred dollars over spot. Today, those checks cleared, and I paid off my truck. I'll be buying back into world gold coins over the next several months.

Anyway, to Rich's point, I think demand is high. What I'm not certain of is if the market is going to really crash dragging PMs back down further. It's possible. I made a defensive play by selling some coins, paying off my truck, and limiting my liabilities. I have a low risk tolerance.

Prices way over grey sheet. I'm more of a collector.

How was the show ?

Win

NES Member

It's a smaller show and I actually enjoyed that. I was there early but it wasn't terribly crowded which was nice since I was offering coins to dealers. There was a good amount of US coins, silver, bullion gold and platinum, and generic pre-33 gold. There wasn't much in the way of 19th century world gold that I tend to buy these days. I bought a 1696 and a 1822 crown. Both are well worn and raw. I had positive, friendly interactions with John from Rare Coin Dealer Boston Area • Coin Rarities Online and Frank & Tom from Buying and Selling Rare Coins at Northeast Numismatics I'll definitely go again.

Share:

Similar threads

- Replies

- 7

- Views

- 94

- Replies

- 11

- Views

- 1K