I believe smart money realizes that the Fed has played it’s hand. Or everyone is just dumb.The most interesting piece, to me anyway, is that we got a 75 BP rate hike and the dollar fell.

-

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold and silver prices are down

- Thread starter Rider

- Start date

smokey-seven

NES Member

Still got my eye on Platinum as it’s way undervalued still.

Win

NES Member

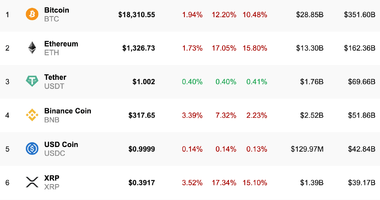

Still overvalued by $18,310.55

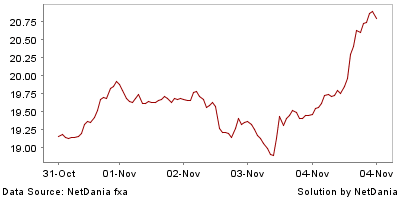

Just wait as the selling of us debt by the likes of Japan and China ramp up even more.Over the past month US Dollar is down 3.16% against a basket of foreign currencies.

Bitcoin getting crushed today along with other cryptos. Bitcoin down 12.20% today.

View attachment 683717

Varmint

NES Member

The last 3 months had the highest ever gold buying by central banks, think it was 300 tons.

Nothing to see here, move along and keep buying your 60/40 portfolio.

Varmint

NES Member

I believe smart money realizes that the Fed has played it’s hand. Or everyone is just dumb.

There's a lot going on. Japan's been intervening the strengthen the yen (which brings the dollar down), China is talking about dropping the No-covid policy (gold up, dollar down on the news), and the 3 month to 10 year yield curve inversion is probably dollar bearish since it means recession.

The dollar weakness is probably temporary.

Everyone also missed the Treasury announcement on Monday last week that A. The deficit will double in 2023 and B. The treasury market faces illiquidity. I realize many factors are at play and there are several worm holes to discover in this geopolitical quagmire. I do think the dollar faces a brief bearish sentiment. Almost every US note in inverted and I expect more proppant for foreign currencies, more price controls on gold, more balance sheet cleansing, more net sales of US treasuries from foreign central banks, and eventual Fed facing the music with only 2 options left: print or die. Do we really think they will reach a terminal rate of 5% or 6 % without completely ruining the global economy all for mere “confidence”? Insolvency is the end game at that level.There's a lot going on. Japan's been intervening the strengthen the yen (which brings the dollar down), China is talking about dropping the No-covid policy (gold up, dollar down on the news), and the 3 month to 10 year yield curve inversion is probably dollar bearish since it means recession.

The dollar weakness is probably temporary.

Still got my eye on Platinum as it’s way undervalued still.

I've been thinking this for years, but it just doesn't seem to move

richc

NES Member

I've been thinking this for years, but it just doesn't seem to move

One of the issues with platinum is industrial uses have dropped.

Catalytic converters used to use a lot of platinum, but it was cost prohibitive. Other materials are used now, lowering demand.

Varmint

NES Member

Just a reminder, sports fans, in the 1970s inflationary hell, gold dropped from $200 to $100 when the Fed started raising interest rates.

Then gold went from $100 to $850 despite rising interest rates.![Popcorn [popcorn] [popcorn]](/xen/styles/default/xenforo/smilies.vb/043.gif)

A similar run would take gold from the $1000 low in 2016 to $8000. Make sure you take some profit by then.

Then gold went from $100 to $850 despite rising interest rates.

![Popcorn [popcorn] [popcorn]](/xen/styles/default/xenforo/smilies.vb/043.gif)

A similar run would take gold from the $1000 low in 2016 to $8000. Make sure you take some profit by then.

So it’s probably likely to pull back some more before it goes up again?Just a reminder, sports fans, in the 1970s inflationary hell, gold dropped from $200 to $100 when the Fed started raising interest rates.

Then gold went from $100 to $850 despite rising interest rates.

A similar run would take gold from the $1000 low in 2016 to $8000. Make sure you take some profit by then.

I’m starting to figure out that I’m glad I didn’t buy PM’s as an investment…though I’m up on silver still, I’m definitely in the hole on gold.

No plan to sell and just sitting on it all until if/when I ever really need it. Might still buy one more 1/2oz eagle to round out my collection but I don’t see myself buying much more for now. With my 401k portfolio and cash down a little, I think I’m a little heavy on PM’s percentage wise. Not a horrible thing if the scenario you mention plays out, but that would also likely mean the dollar goes to shit at the same time, right?

Varmint

NES Member

So it’s probably likely to pull back some more before it goes up again?

I’m starting to figure out that I’m glad I didn’t buy PM’s as an investment…though I’m up on silver still, I’m definitely in the hole on gold.

No plan to sell and just sitting on it all until if/when I ever really need it. Might still buy one more 1/2oz eagle to round out my collection but I don’t see myself buying much more for now. With my 401k portfolio and cash down a little, I think I’m a little heavy on PM’s percentage wise. Not a horrible thing if the scenario you mention plays out, but that would also likely mean the dollar goes to shit at the same time, right?

Well, gold has been consolidating for over 2 years so it can certainly vascillate a little more before it makes the move to above $2100. We're not likely to see that before either the Fed starts cutting rates (not pausing but actually cutting) or restarting QE, or if the stock market crashes you could see a rotation into gold.

Right now the central banks are big buyers of gold, and retail investors are selling or shorting it.

Gold miners are an investment, gold is more like insurance or a currency (that doesn't constantly lose purchasing power).

richc

NES Member

Well, gold has been consolidating for over 2 years so it can certainly vascillate a little more before it makes the move to above $2100. We're not likely to see that before either the Fed starts cutting rates (not pausing but actually cutting) or restarting QE, or if the stock market crashes you could see a rotation into gold.

Right now the central banks are big buyers of gold, and retail investors are selling or shorting it.

Gold miners are an investment, gold is more like insurance or a currency (that doesn't constantly lose purchasing power).

An extraordinarily strong US dollar has driven down the price of gold. And personally I believe that a lot of "safe haven" buying of gold went to cryptos over the past few years. With recent upheavals in the crypto market it's possible we'll see any flight to safety move back to gold.

I was just watching my premarket GDXU holding fly to the ceiling. I bought in 2 weeks ago at $23. Sometimes I’m smart.

Must be something brewing in the background we do not know of yet. MM’s short covering even more or HF’s putting smart money to work.

Varmint

NES Member

CPI came in at 7.7%, so everything is blasting off.

Buy the Dip baby!

Win

NES Member

A few days ago some bozo on this forum (it was me ![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif) ) said that they saw PMs declining in the near term. Now I'm not sure. What's your guys thoughts? Are the lows in? And bonus question: what's your confidence level in your opinion. I'll go first:

) said that they saw PMs declining in the near term. Now I'm not sure. What's your guys thoughts? Are the lows in? And bonus question: what's your confidence level in your opinion. I'll go first:

Lows might just be in. Confidence level 3%

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif) ) said that they saw PMs declining in the near term. Now I'm not sure. What's your guys thoughts? Are the lows in? And bonus question: what's your confidence level in your opinion. I'll go first:

) said that they saw PMs declining in the near term. Now I'm not sure. What's your guys thoughts? Are the lows in? And bonus question: what's your confidence level in your opinion. I'll go first:Lows might just be in. Confidence level 3%

Gold is soley controlled by the paper markets which follow equities closely. Dollar down, gold up. Inflation down, gold up. Treasuries down, gold up. We have pretty much peaked in the usd, 10yr treasuries, and inflation…….for now. Gold needs to decouple from equity and paper markets for an appreciable change. When bad global economic news comes back we may get the decoupling we have longed for. Many unknowns still wrt to Fed policy but we are clearly in a mid term/ Santa Claus/ end of year rally which is taking gold up with everything else.A few days ago some bozo on this forum (it was me) said that they saw PMs declining in the near term. Now I'm not sure. What's your guys thoughts? Are the lows in? And bonus question: what's your confidence level in your opinion. I'll go first:

Lows might just be in. Confidence level 3%

The things that matter most to me is the smart money moving into gold (ie, central banks buying recently) and real yields being negative.

Let me get this straight. The CPI drops to 7.7%, and based on that one positive indicator, investors decide we're not heading into a recession and start buying stocks like crazy? "Hey, the CPI dropped to 7.7%, all is well, recession canceled. Let's get back to the bull market!"

Individualist

NES Member

- Joined

- Jan 24, 2009

- Messages

- 4,663

- Likes

- 4,366

Well, you know the way things are today with the gov being so trustworthy, it might be. It's just such a strong reaction to 7.7 instead of 7.9 and the fed maybe raising rates 2 basis points instead of 3 in December. There are still some crazy ass inversions in the Treasuries market. What is this, Mardi Gras?

Varmint

NES Member

Let me get this straight. The CPI drops to 7.7%, and based on that one positive indicator, investors decide we're not heading into a recession and start buying stocks like crazy? "Hey, the CPI dropped to 7.7%, all is well, recession canceled. Let's get back to the bull market!"

Yes, exactly. This tells you we have not hit bottom, that the Buy the Dip bubble market mentality is still alive and well.

Win

NES Member

Varmint

NES Member

So 5 French francs is 75 cents - is that what you paid for it?

Varmint

NES Member

And just like that Gold cleared $1680, $1700, $1730 and $1750 resistance.

Intersting when you consider that 7.7 rounded off is 8% inflation.

Intersting when you consider that 7.7 rounded off is 8% inflation.

Share:

Similar threads

- Replies

- 7

- Views

- 95

- Replies

- 11

- Views

- 1K