Varmint

NES Member

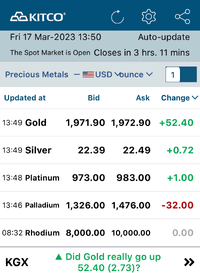

Feels like we're on a slow march back over $2000. I don't sense the bad news is over, and could get worse. Add that to nervous investors and you have a perfect storm.

View attachment 732668

Friday close over $1950 would be big. Gold miners probably won’t rally til we see $2000 though.