413dan

NES Member

I had been periodically checkingWhat number are you looking at? Futures high after hours seems to be $1904.

Gold Price Today | Gold Spot Price Charts

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

I had been periodically checkingWhat number are you looking at? Futures high after hours seems to be $1904.

I’m not sold on the gold breakout. Bitcoin at 19k indicates a lot of selling left.

If they are selling into a rising price, then they are OK. It's the buy back in that costs.I think that's the first time I've seen my numismatic friends guess wrong. Interesting.

It's all manipulated. 'They' make money on the way up and they make money on the way down!it’s definitely not a breakout yet anyway, and even if we get through $1900 there’s huge resistance at $1950 and $2000. Then it’s back to test $1750 or something.

We’ll get that breakout above $2000 when the Fed pivots, but I think that’s farther away then the markets think.

I think that's the first time I've seen my numismatic friends guess wrong. Interesting.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Well gold certainly is getting bid after Yellen’s warning to Congress on the debt obligations. This should be fun to see after 2022’s tax loss selling if income tax receipts even come close to what 2021 brought in! We’re in big trouble folks…

Wait what happens in 4 hours?

Miner and silver rally seems tapped out, they barely went up today, but still great close to the week. All those experts calling for $1500 or even $1400 gold - GLWT.

I have a question for you experts here...

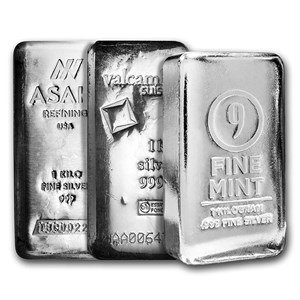

Say I have 50 oz of gold in a health mix of 1oz coins, fractional coins, some pre-1932 coinage and a few 1oz bars. Of course, the minimum value one would expect at any given time would be melt value. Given the description above, what would a fair percentage premium over melt would you guys think would be a fair estimate of real value (in FRN's)?

10%?

20%?

36.43%?

What say you PM wizards of NES?

Great idea. That addresses my concern whereby dealer prices are vastly over inflated.Are you selling to a dealer, or personal sale?

That makes a difference.

Personally, if selling by myself, I'd look at melt, and what dealers are selling for, and price it in the middle. Win-win.

![Rockon [rockon] [rockon]](/xen/styles/default/xenforo/smilies.vb/020.gif)

They gotta make money somehow?Great idea. That addresses my concern whereby dealer prices are vastly over inflated.

Thanks!

This is true but there is some price gouging going on, that's for sure!They gotta make money somehow?

I’ve had good luck buying here through personal sale and other sites in FTF transactions.

This is true but there is some price gouging going on, that's for sure!

Again, quite true sir!Supply and demand. An informed buyer/seller will always do better.

Apmex and jm bullion list buy prices for lots of things on their websites.I have a question for you experts here...

Say I have 50 oz of gold in a health mix of 1oz coins, fractional coins, some pre-1932 coinage and a few 1oz bars. Of course, the minimum value one would expect at any given time would be melt value. Given the description above, what would a fair percentage premium over melt would you guys think would be a fair estimate of real value (in FRN's)?

10%?

20%?

36.43%?

What say you PM wizards of NES?

On a percentage basis silver was up more than gold today. Silver was up over 2%, while gold was up about 1.3%.

Am I missing something?

Apmex and jm bullion list buy prices for lots of things on their websites.

Buy Gold & Silver Bullion Online | Free Shipping - JM Bullion

Current “sell to us” price of $1,963

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Are you selling to a dealer, or personal sale?

That makes a difference.

Personally, if selling by myself, I'd look at melt, and what dealers are selling for, and price it in the middle. Win-win.

It’s just one negative indicator, there are a lot of positive ones, especially now that gold closed the week not just above $1900 but above the next resistance level at $1920.

So…about that afterhours chat. Are you content?