Long reply gang.....

Let's say gold hits $20K/ounce because of hyperinflation

So what the hell do you trade for that'll represent a store of value and not lose money?

A couple points. If gold hits 20K an ounce, You will not get cash for it, cash will be worthless like wheel barrows of Nazi currency in 1945. You will only get, “Stuff” for it.

You do not trade for a store of money, you trade for commodities. If you trade well, you improve your position, trade badly, you lose value.

But seriously, where does one place their savings in a hyper-inflationary world?

After that gold might not even be legal to own. So trade your $10k gold

You do not put, “savings” anywhere. You buy stuff that is in demand and sell stuff that will make money. Quick turnovers as, “stuff changes prices” hourly. If gold is illegal to own, but it, sell it for another metal. If you own “gold paper” and gold becomes, “illegal”, good luck with that paper. IN HAND metal only people.

Personslly, I am staying in stocks, with a small side of gold, guns and ammo.

I wish you well.

Yeah I was joking about guns, they don't retain value unless collectible.

Oh they do! Don’t buy junk, buy decent quality at a fair price and it will out perform inflation. If you want some examples, I will provide them. 10 - 20 years will out perform inflation or at least maintain equality.

Real estate is driven by the same supply/demand mechanism that determines most prices.

I think the population in Mass has been declining, so why have housing prices increased?

Real estate is not always supply/demand. I look back at 1980’s and saw local RE prices fall over 50%. If you sold well just prior to that, moved to a depressed locale out of state, you could have quadrupled your RE investment.

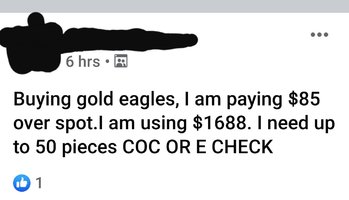

A lot of you guys are talking up eagles, kruggerrands, notes, etc.

Buffaloes are my favorite. I think they’re the best looking of all.

I passed away from gold, as it leaves too much of a taxable footprint. Cash 10 Gold 50$ eagles and you will find a 1099 in the mail. See my previous discussions on this.

The American Eagle and Krugerrand contain 1 ounce of gold but contain some other metals to improve durability.

I suggest you look at the US Tax laws on selling FOREIGN gold as opposed to US gold. Sure, small amounts can slide by but try 30K of Krugs.

.

www.kitco.com